PORTFOLIO

BACKTESTING

WITH NO LIMITS

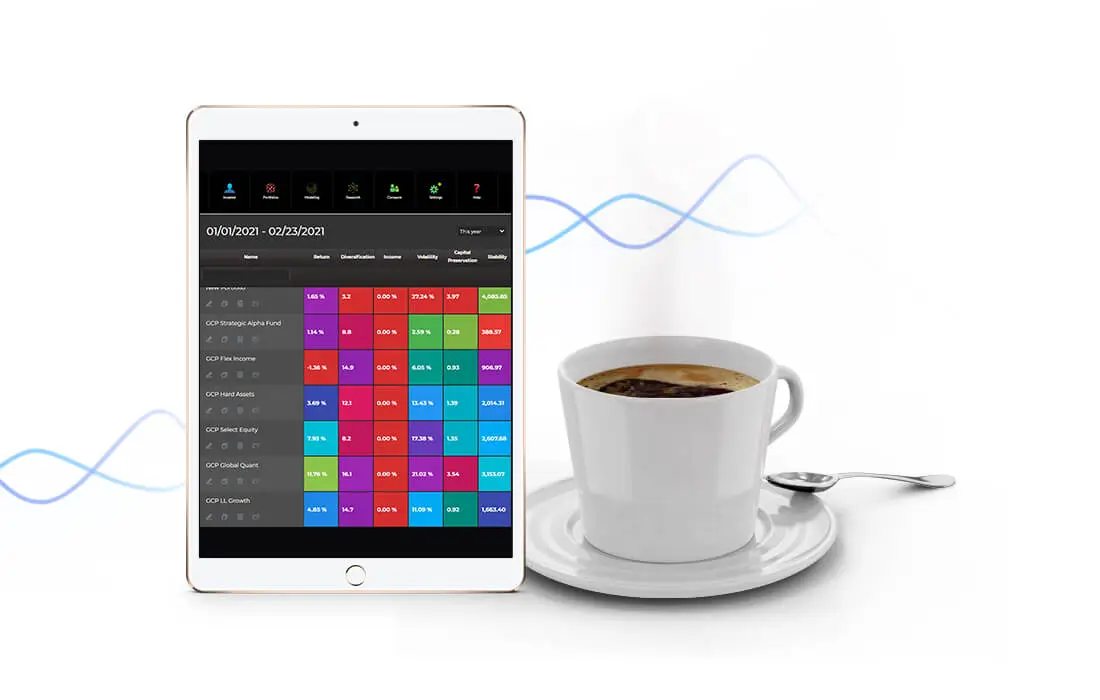

Backtest, optimize, analyze and automate a better portfolio strategy using our patented science of diversification. The systematic discipline of diversification works to improve nearly any portfolio. Whether you have an existing advisor, portfolio strategy or are starting from scratch we can help deliver better investment performance, without gimmicks or unnecessary risk. Get a Free Backtest and Analytics Now. Portfolio ThinkTank

PORTFOLIO BACKTESTING WITH NO LIMITS

Backtest, optimize, analyze and automate a better portfolio strategy using our patented science of diversification. The systematic discipline of diversification works to improve nearly any portfolio. Whether you have an existing advisor, portfolio strategy or are starting from scratch we can help deliver better investment performance, without gimmicks or unnecessary risk. Get a Free Backtest and Analytics Now.

A simple 5 step guided process based on your preferences

Design your portfolio

Analyze your portfolio backtest report and test any variations until you are satisfied

Fund your account and take your new strategy live… or just watch the portfolio performance develop

Sit back and let Portfolio ThinkTank provide anonymous, validated, contextual optimal suggestions to improve your portfolio

See Lisa’s investment journey and her decision to take control of her investment portfolio.

Portfolio ThinkTank is taking Aim at Wall Street:

Wall Street investment advice is mired with hidden, layered, and complex fees, conflicts of interest, misaligned incentives, impersonal advice, untested recommendations, expensive commissions, clingy salespeople, naive diversification, cookie-cutter models, proprietary products, and fiduciary negligence.

Portfolio ThinkTank users know that they can do better.

22 WAYS WE HELP YOU SUCCEED

Diversification

Your portfolio is optimized using our patented Diversification Optimization.

We use downside diversification. We invented this econometric filter, which better enables the investor to diversify their risks without diluting their opportunities.

We patented Diversification measurement. Diversification is important and you will see how yours measures up.

We’ve made diversification the bedrock of the portfolio. Diversification is the most stable portfolio optimization input. This means that there’s a greater convergence between the historical simulations produced and the real-world results achieved.

A Systematic Process

We follow a systematic process that insulates the portfolio from emotionally driven decisions, preventing buying and selling at the wrong times.

The entire portfolio is designed and tested to work together, holistically. This enables disparate but complementary processes to work better together. One simple example is matching the forecasts to the re-optimization intervals.

We combine idiosyncratic asset volatility, asset non-correlation, and re-optimization and rebalancing activities to act as a profits ratchet, also known in quantitative circles as volatility pumping.

Personalization

We regularly update our investment themes and the assets inside them to give you opportunities to invest in things that can produce performance.

We’ve expanded the selection of the objectives that the portfolio performs against. This means the portfolio does a better job of serving your needs because you’ve made a more exact articulation of them.

With Portfolio ThinkTank, you can include your own investment ideas. We’ll take it from there.

Prediction

Our predictions are always based on the latest fundamental, technical, social, and pricing data. Never stale, like forecasts in some portfolio managers’ model portfolios.

We use a risk quantification that better maps to real-world loss of capital. Having better inputs leads to better outputs and outcomes.

OPTIMIZATION

Your portfolio is regularly re-optimized, ensuring that you are equipped with updated assets, predictions, and the best asset allocation for your money now. Most portfolio managers just optimize a portfolio once and then keep rebalancing it. Diversification is a moving target. We help you hit the target.

Your portfolio is rebalanced. Portfolio rebalancing combines diversification and volatility to create incremental returns known as a rebalancing bonus.

EFFICIENCY

We overfeed the system ideas to allow the system to cherry-pick the best subset of assets that meets your objectives, this lets the portfolio operate more efficiently.

Our optimization process is based on maximizing diversification-utility efficiency. Assets not assisting some dimension of this are discarded to remove the dead weight for more efficient performers.

MINIMIZING EXPENSES

Whenever possible we use individual stocks instead of funds. This removes the embedded fees of funds and greatly improves diversification.

We partner with Interactive Brokers which offers some of the lowest commissions in the industry.

WE ARE A FIDUCIARY

We don’t sell our orders to market makers who take the opposite side.

We have no conflicts of interest or products to sell.

We get up every morning obsessed with improving investment performance.