Portfolio Backtesting Software

This blog exists to help investors improve performance by sharing

insight related to our areas of expertise. Blog Portfolio Think Tank

Statements

Systematization

Backtesting

Diversification

Optimization

Investing

Dimensions of Investment Risk and Diversification

A thoughtful Investors' Checklist of Diversifiable Risks I usually think about diversification as abstract dimensions, what some people call stat factors: they do not have discreet meaning individually, but collectively add it to measure the information /...

First Principles of Investments

What are the First Principles of Investments? Investing in the stock market requires clear thinking. These are the rules of the game. Not guidelines, not suggestions. Just some facts in a domain where facts may be diluted with great narrative, analysis or...

What are the Top 10 Advantages of Creating and Following an Investment Policy Statement?

An Investment Policy Statement is a collection of policies that institutions used to use to govern how their portfolios where managed. They still do. Some Investors use this to, usually very wealthy investors. Portfolio ThinkTank has taken the IPS and combined it...

Pro Grade Portfolio Analysis

Trading Rules

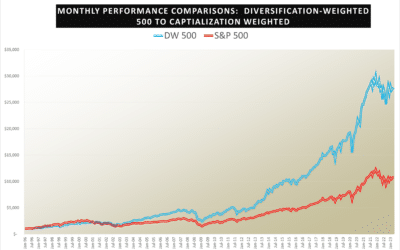

Diversification Returns and Diversification Alpha

Just like Deion Sanders on the field, diversification goes both ways. Most investors intuit the benefit of defensive diversification, but diversification can play offense, too. The defensive ability of diversification to protect capital is a function of the...

Inflation Proof your Conservative Investment Portfolio

The biggest misconception on diversification

Fact Checking for Truths about Portfolio Diversification There are a number of misconceptions around diversification. But head and shoulders the number one misconception is so widespread, harmful and misunderstood. First, the also rans. Debunking the Biggest...

Gratitude Practice

In addition to an overload of turkey every Thanksgiving table I’ve sat at has had some sort of gratitude practice. Sometimes, this takes the form of going around the table where people can express things that they are thankful for. Other times the host could lead a...

Are you a wartime investor?

Many investors, especially venture capitalists, differentiate CEOs as either peacetime or wartime leaders. The concept of "wartime" is often used to describe national leaders facing crises. Investors should consider adopting this perspective for their own...

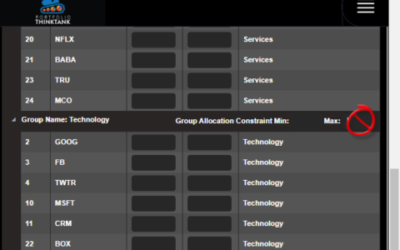

Skip the Max Constraint on your Tech Stock Allocations

Strategic Tech Stock Allocations for Optimal Investment Growth Proper Portfolio Construction is both art and science. Here is a little art. Why you should constrain all of your sectors except technology? What are portfolio constraints? Position constraints are a...

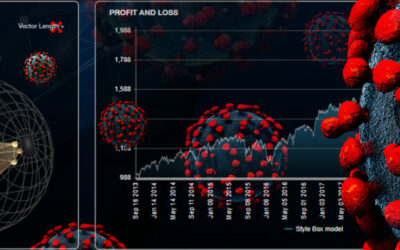

COVID 19 Stock Ideas

I track a list of 3 COVID 19 Stock ideas. Harmed is an equally weighted basket of 33 stocks that would stand to get their butt kicked by COVID19 and the resulting shutdown. Beneficiaries is an equally weighted basket of 33 stocks that one could imagine would benefit;...

Narrative Diversification

Narrative Diversification - What is it and why does it matter? I want to call to attention a type of diversification that I think is especially relevant now and typically one that evades measurement. Narrative diversification. I've come across this type of...

Large Cap vs Small Cap – Who Will Win for the 2020’s ?

Large Cap vs Small Cap Investing: - Tilt your portfolio exposures for better investment performance. Historically, small cap stocks have outperformed large cap stocks. This no longer appears to be the case. Too bad, because there is a lot of diversification to be...

The Dirty Secret of Diversification

The Dirty Secret of Diversification You probably heard mixed things about diversification; most of it good but not all of it. Amongst the detractors you can find content on the internet where Mark Cuban or Warren Buffett impune diversification. Please forgive their...

Coronavirus Investing

Cash + Quality + Cap = Comebackability A great many stocks are excellent investments right now. With the Coronavirus, I keep finding myself saying that “this too shall pass.” It will. Sooner or later. And when it does - you need to be ready. As there have been many...

Are you a Trader or an Investor?

I’ve been thinking a lot about this lately. The recent impact of the coronavirus fears on the stock market, like any other fast-moving or high-volatility event arouses my trader's instincts. Are those trader's instincts compatible with fiduciary, long-term investing?...

The Seven Deadly Sins of Portfolio Backtesting

The vast majority of investors wanting portfolio backtesting have good intentions. But even the well-intentioned investor may make some mistakes that can lead to dangerous consequences. These seven deadly sins of portfolio backtesting may cause misleading results and...

The Gold Standard for Portfolio Backtesting

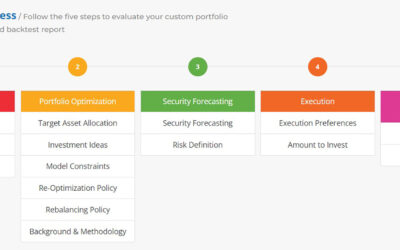

Who is Portfolio ThinkTank Designed for?

We exist to help investors... Investors who are smart enough to realize that they can create investment strategy themselves and smart enough to know that they can beat the averages, yet self-aware that it’s ok to get some help. We love tech-savvy investors and we love...

The Thirteen Virtues of Portfolio Backtesting

These are the virtues of what a good backtest is and what it can do for investors. These are the virtues The Gold Standard for Portfolio Backtesting. Includes the impact of portfolio rebalancing Ideally, the backtest should cover a period long enough to cover at...

What is a Backtest?

A backtest or back-test is a hypothetical simulation of an investment or trading strategy. Most backtesting is applied to timing entry and exit points for a particular asset. Backtesting is one of those things that can be easy to quick and hard to do right. Portfolio...

Why are we launching Portfolio ThinkTank?

My name is James, and I’ve been a B2B fintech executive for 19 years, selling millions of dollars of tech to professional investors. Now, with Portfolio ThinkTank, I’m changing teams. Why are we launching Portfolio ThinkTank? Because I want to help regular investors...

Is WFOOSMPBT acronym worthy?

Is WFOOSMPBT acronym worthy? A backtest has about as much credibility with professional investors as claims of sure things and guarantees. However, a backtest is an incredibly useful research tool—if it is done right. If it is done wrong, as most are, it gives a false...

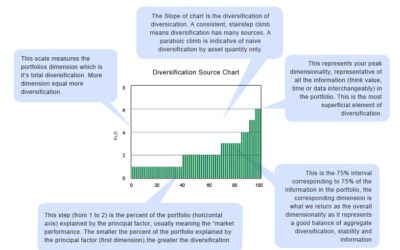

Systemic Risk and Diversification Analysis

This chart tells us that the portfolio being analyzed has a variance 60% captured in only one dimension. Minimizing the percentage of the portfolio captured in the first dimension is a routine output of our investment process and greatly reduces the susceptibility of...