What are the First Principles of Investments?

Investing in the stock market requires clear thinking. These are the rules of the game. Not guidelines, not suggestions. Just some facts in a domain where facts may be diluted with great narrative, analysis or expectations. Return to these first principles for investors to get reset and build an enduring wealth strategy and disciplined mindset. To make your life easer first principles of investments is importance

What are first principles?

First Principles are the truths that engineers and scientists use to build their systems around. They are the foundational building blocks. the ancient Greek philosopher, Aristotle was the original champion of thinking in first principles. These principles are a cornerstone of logical thinking and have survived since the time of Aristotle in 350 BC. Aristotle defined first principles as the “first basis from which a thing is known.” By taking a first principals perspective we can separate the signal from the noise: cutting through the B.S. to get to the salient information required to succeed. First principles thinking is not just some ancient Greek philosophy, Elon Musk, for one advocates First principles thinking in his companies. IT seems especially important in investments.

There’s a lot of noise in investments so starting with some irreducible truths is a smart move. Here our list is loosely prioritize so the most important truths are at the top. Some of it may be painfully obvious, but many truths are no obvious and investors armed with a greater understanding of investment universe are at a big advantage. We start with these truths – these axioms of investing and as we go down the list we include a few things are are merely probabilistic, but still so pervasive and likely that investors would do well to think of them as truths.

List of the First Principles of Investments

- It takes money to make money.

- Buy low and sell high.

- Compound interest lets your money work for you. Returns on investments compound when not withdrawn. This compounding creates an opportunity for larger and larger gains when protected from losses.

- Losses and gains are not equal. Losses are worse. A loss of 50% requires a gain of 100% to break even. Because gains and losses are not equal and losses count more than gains, more attention should be paid to losses than gains.

- Fees for investments can make a material difference in the overall return. The greater the fee the less the return. Both mutual funds, Exchange traded Funds as well as other funds such as hedge funds and private equity / venture capital funds collect fees. Since the fee for a fund is generally knowable, the evaluation of the performance of any fund should always be made net of fees, and the return of the fund should be made comparable to a well-fit benchmark wher

- e the performance and performance potential of the fund having a fee should be justified.

- Investors are owners.

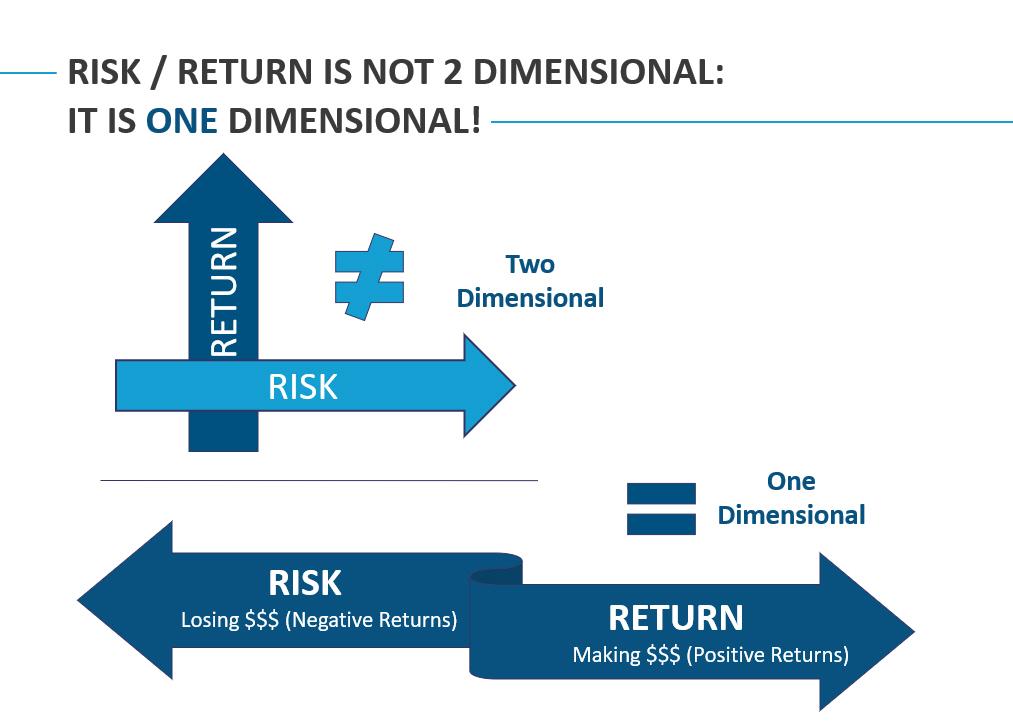

- Risk and return are not really two things, they are the same thing. risk is losing money which is a negativereturn. All the fancy efficient frontiers and risk and return estimation procedures should not divert your attention from this simple fact.

- Investments that have future cash flows which accrue to the owners have intrinsic value based on the Net Present Value (NPV) of the future cash flows.

- Investments that are not supported by any future series of cash flow are subject to supply and demand only.

- Diversification reduces the variance of performance which increases the convergence between the mean and median return, thus increasing the future probability of the desired result.

- Investors should require additional returns for taking risk.

- The return on any investment must begin by the return of that investment.

- An investment has a rate of return and it also has a real rate of return, the real rate of return is simply the rate of return on that asset less the rate of inflation The risks of any investment include, liquidity risk, fraud risk, counterparty risk, systematic risk, idiosyncratic risk, management risk, pricing risk.

- Discipline, Stoicism, policies, process and Systemization help inoculate investments from cognitive bias, and emotional reactions, which typically work against investors from achieving their best performance.

- There is no such thing as a risk-free investment.

- Price is a function of its supply and its demand. A stock with attractive fundamentals could stay low forever if it’s not in demand by investors. This is known as a value trap.

- Jim Simons’ Renaissance technologies has produced an average net fee return over 35% for over 30 years unequivocally proving that the markets are not operating efficiently and setting the bar for what might be possible.

- Short sellers of a stock must buy it back later, because short sellers are exposed to unlimited loss potential, short investors typically actively manage this risk and are somewhat loss intolerant.

- Investments held less than 1 year are subject to a different tax regime lowering the overall return.

- Markets are a compilation of buyers and sellers.

- Talent exists but is hard to to evaluate.

- A gain achieved over a shorter period provides a faster return than the same gain attained over a longer period.

- Options allow investors to express a myriad of positions beyond just up or down.

- Investments held for a longer period have greater risks, owing to the opportunity costs.

- A gain attained faster enables the investor to make new investments more rapidly.

- Stocks are lower down the capitalization structure than bonds or royalties.

When choosing investments or designing an investment strategy, it is good to think of these principles. Have ideas for other principles? I want to hear them! email me.

James’ professional orientation points at the zenith (and sometimes nadir) where technology and investments intersect. He is a Fintech entrepreneur and has served twenty years of a lifetime sentence.

James is a patented inventor, quant pioneer and investment manager. He is the founder of Gravity Investments, a unique investment and technology services firm centered on James’ inventions for diversification measurement, optimization, visualization, and analysis. In the development of the platform, James has pioneered A.I applications, diversification attribution, down-side diversification, portfolio re-optimization, full-lifecycle strategy optimization, programmable investment policy statements and core-satellite optimization techniques.

In working with advisors, funds and money managers as both a strategic sub-advisor and software consultant, James has consulted and trained hundreds of professional investors on portfolio design and optimization. James has a unique ability to look at any investment process and find practical, intelligent and often quantifiable opportunities to improve the investment product.

Inspired by the work of Nobel Laureate Harry Markowitz and the efficient frontier, James has championed and pioneered the science of diversification. James’ technology has advised

or assisted in over 30 Billion dollars of investor capital. His vision of a more perfect investment management system is at the heart of Gsphere ( www.gsphere.net )

His passion for performance, curiosity for the unknown, and drive to excel empower his service to investors.

James is Founder and CEO of Portfolio ThinkTank (the B2C company) www.portfoliothinktank.com, Founder & Chief of Financial Engineering at Gravity Investments www.gravityinvestments.com (the B2B company) and Chief Investment Officer at Gravity Capital Partners, a wholly owned SEC Registered Investment Advisor.