I track a list of 3 COVID 19 Stock ideas.

Harmed is an equally weighted basket of 33 stocks that would stand to get their butt kicked by COVID19 and the resulting shutdown.

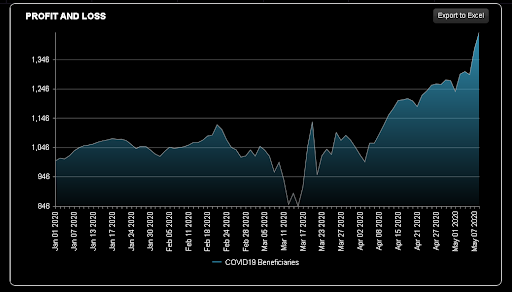

Beneficiaries is an equally weighted basket of 33 stocks that one could imagine would benefit; such as

Work from Home is an equally weighted portfolio of 9 stocks that should benefit from more people working from home.

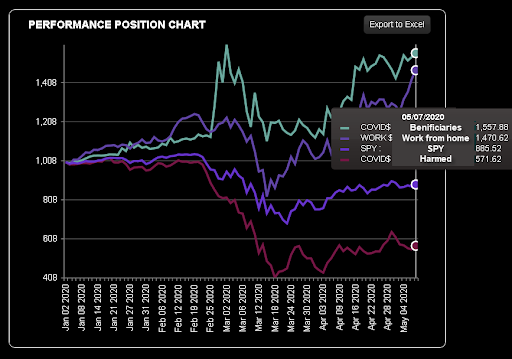

Here is how they have performed YTD including the S&P 500 benchmark

I think the take away here is just how good the beneficiaries have done.

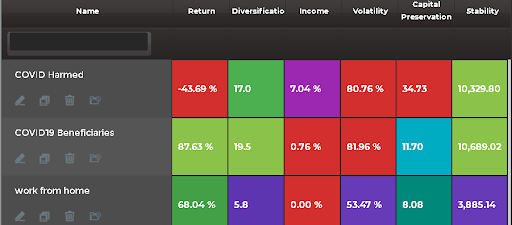

Here are the stats form the YTD period

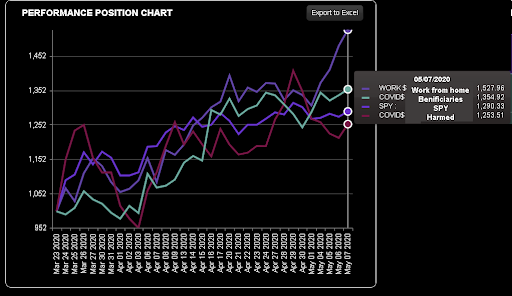

Now I will isolate the performance from March 23; the nadir of the COVID19 market decline.

I think it bears special attention just how good COVID beneficiaries have done. Again here is the YTD:

You can use my free portfolio builder https://portfoliothinktank.com/ to create the best backtested portfolios based on our rigorous process to get the backtests trustworthy https://portfoliothinktank.com/tag/portfolio-backtester/

James’ professional orientation points at the zenith (and sometimes nadir) where technology and investments intersect. He is a Fintech entrepreneur and has served twenty years of a lifetime sentence.

James is a patented inventor, quant pioneer and investment manager. He is the founder of Gravity Investments, a unique investment and technology services firm centered on James’ inventions for diversification measurement, optimization, visualization, and analysis. In the development of the platform, James has pioneered A.I applications, diversification attribution, down-side diversification, portfolio re-optimization, full-lifecycle strategy optimization, programmable investment policy statements and core-satellite optimization techniques.

In working with advisors, funds and money managers as both a strategic sub-advisor and software consultant, James has consulted and trained hundreds of professional investors on portfolio design and optimization. James has a unique ability to look at any investment process and find practical, intelligent and often quantifiable opportunities to improve the investment product.

Inspired by the work of Nobel Laureate Harry Markowitz and the efficient frontier, James has championed and pioneered the science of diversification. James’ technology has advised

or assisted in over 30 Billion dollars of investor capital. His vision of a more perfect investment management system is at the heart of Gsphere ( www.gsphere.net )

His passion for performance, curiosity for the unknown, and drive to excel empower his service to investors.

James is Founder and CEO of Portfolio ThinkTank (the B2C company) www.portfoliothinktank.com, Founder & Chief of Financial Engineering at Gravity Investments www.gravityinvestments.com (the B2B company) and Chief Investment Officer at Gravity Capital Partners, a wholly owned SEC Registered Investment Advisor.