Fact Checking for Truths about Portfolio Diversification

There are a number of misconceptions around diversification. But head and shoulders the number one misconception is so widespread, harmful and misunderstood.

First, the also rans.

Debunking the Biggest Misconception on Diversification

- Diversification is De-worse-ification Wrong. Diversification can only lower returns when you allocate to worse performing assets. Don’t blame diversification that all your investments are not as good as your best investment and don’t invest in (especially buy and hold) bad investment simply for diversification.

- Diversification does not work when you need it most This one is tricky. There is some truth to this idea, but it it is much more limited in real world application, than assumed by its progenitors. Yes, diversification will begin to fail during systematic (liquidity) crisis. Here we are talking generational black swan events. So yes, it might fail in the worst ones but it will help in the other 5 lesser crises or economic shocks, it is really just liquidity crisis when diversification really evaporates. Even then, Diversification Optimization will recognize that less diversification is available and will necessarily increase allocations to cash as the quintessential counterbalance. So fact checking the idea that diversification fails when you need it the most

- Diversification guarantees success. See # 2. Some people think too much of diversification, some people think too little of it. We have found that diversification actual works its mojo best during choppy or sideways markets, not during the steepest declines.

OK. With those lesser myths of diversification dispelled. What is the # 1 biggest misconception about Diversification?

Sadly, the number one misconception about diversification, is a by-product of those ignorant or deceitful marketing practices of the investment fund industry.

It is kind of like the food pyramid from the 70’s and 80’s. Before being replaced by My Plate, the food pyramid facilitated dangerous advice on nutrition worsening the Obesity crisis over the last 50 years. Your portfolio needs funds in it about as much as healthy humans need to base their diets on agricultural grains.

The biggest misconception of Portfolio Diversification is that adding funds helps diversification.

To be clear, funds hurt diversification.

Can you hear the angry grumblings from the wall street establishment? They argue that not all funds hurt diversification. They are correct. Not all funds hurt diversification and not all the time; Just most funds and most of the time.

They argue what about all the diversification inside the fund? That’s what counts. Here they are wrong.

This is a powerful and stuble point. Let me unpack it for you and in the process give you a 10,000 overview of how the finance industry has evolved to get this so wrong.

The Diversification of an investment portfolio is independent of the portfolio’s risk or return. But the diversification may influence both the return and the risk. The impact of risk is well studied and forms the basis of modern Portfolio Theory (MPT). This was the world’s first Portfolio Optimization, invented by Nobel Laurate Harry Markowitz to incorporate diversification – exclusively as non-correlation – to reduce the standard deviation of portfolios and create efficient portfolios. An efficient Portfolio is one that had been optimized. Markowitz Invented Mean – variance efficient portfolio. He indirectly used diversification but stopped short of measuring it. That’s where James Damschroder stepped in – to extend the MPT framework to explicitly measure portfolio diversification and optimize for it directly.

The diversification that exists inside the fund has a benefit to the investors. Absolutely. But the diversification that exists inside the fund does not inure to the investor. In other words, the investors gets whatever benefit of diversification created by the funds internal diversification. The fund passes that diversification benefit to investors in the form of better risk and return on their daily net asset values.

Diversification goes with control. If you can not control how a fund is managed, you do not get the diversification it has inside, you get the benefit of the diversification. If you buy a fund, whether it is a mutual fund, Exchange Traded Fund (ETF) or private fund, you are not in control.

If you were in control, and since you are a wise ThinkTank Operator, then you would want to maximize the not just the risk-reduction benefits of diversification, but you would install re-optimization, asset allocation and rebalancing policies that enabled diversification to create diversification alpha, an added source of returns to the portfolio.

Since, these benefits may be several percentage points of investment performance every year, you can see how it is inappropriate to count the funds internal diversification as most fund managers are returning a paultry fraction of the net diversification benefit possible.

Funds promote diversification and are held entirely unaccountable.

So, don’t believe anyone when they talk about diversification. The industry does not know what they are talking about.

Any fund can promote its incredible diversification, with total impunity even if the statement is false. There is no one there to hold them accountable. The Securities and Exchange Commission or other Regulators simply just haven’t had the tools to sort out claims of diversification. They don’t know the difference. This has enabled funds and fund managers, marketers and investment advisors to promote diversification benefits of a fund even if it does not exist. Lord, forgive them for they know not what they do.

Diversification measurement now exists and is a definite attribute of a portfolio, risk like the risk or return. Please see https://portfoliothinktank.com/how-to-measure-portfolio-diversification/.

Diversification always breaks down to two parts, idiosyncratic diversification and systematic diversification.

Idiosyncratic diversification is easy to achieve. Investors get idiosyncratic diversification by owning more positions. It doesn’t matter what the positions are; owning more positions increases idiosyncratic diversification. Funds do a great job of providing idiosyncratic diversification. They own lots of stuff. Investing in a fund for the purposes of owning lots of stuff is like dating someone because they have lots of hair. It’s not a big accomplishment.

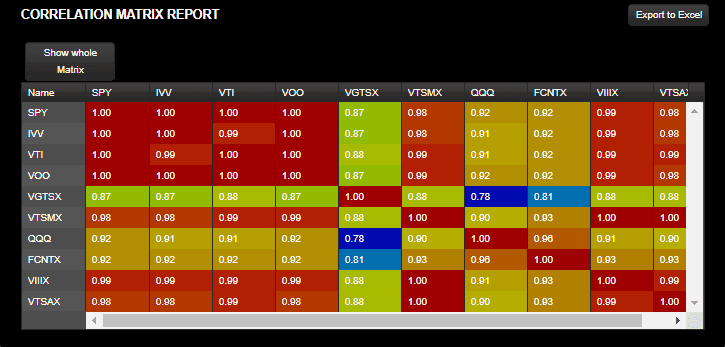

Systematic diversification is about the interrelationships. Usually, we think of this as the correlations amongst the Investments. Systematic diversification is harder to achieve. Scratch that: systematic diversification is hard to achieve. Systematic diversification becomes increasingly harder to achieve as the quantity of Investments increases. This is because every additional investment has to lower the average intra-portfolio correlation, within the correlation matrix.

So why do funds worsen diversification?

Funds basically trade systematic diversification for idiosyncratic diversification. In other words, they give up the hard thing to get the easy thing. That’s like trading in your workout for a candy bar. Not exactly the path of the hero.

Systematic diversification and idiosyncratic diversification count equally.

Optimal portfolio diversification resides in finding the balance.

This usually means investing in fewer Investments that are less correlated to one another.

Here is the Correlation Matrix of 10 of the biggest Equity Funds.

A portfolio of these top 10 Holdings when equally-weighted gave a total diversification score of 3.9

See for yourself:

https://www.gsphere.net/view.html?ref=l1hjc9mrbk4tilqe6qg2

I ran the same Portfolio using the top 10 largest companies instead of the top 10 largest funds. Notice the difference in the correlations…. and that’s with seven of the 10 companies in the same industry!

See for yourself:

Why it all matters.

Here is how this failure to diversify unravels the portfolio. When there’s no difference between assets there’s no utility to rebalancing. Rebalancing needs non-correlation to be effective. Missing out on rebalancing can cause investors perhaps 1% in lost returns a year in conventional portfolios.

What’s worse is that you are paying these fund managers to worsen your diversification and ruin your rebalancing bonus?!!?

More importantly still is the relationship between diversification and capital loss. In research I did with Houyan Sun of the University of Denver after the 2008 crisis, we discovered that every extra percentage point of diversification protected 98 basis points of capital throughout the crisis. This was sampled over about one hundred real world portfolios. We also demonstrated that the increased diversification didn’t cause any investors any upside. That is the essence of diversification as a free lunch.

Diversification is sort of a weakest link problem. Improvements to the weakest link stand to convey the greatest benefits.

Therefore, almost invariably, amongst fund managers, and without even knowing it because the industry is still blissfully ignorant on diversification, what they naively promote as diversification will cost investors all of the benefits hoped.

Any of the rebalancing and reallocation (re-optimization) benefits of diversification inure to the controller of the portfolio. This means that investors in the funds get some of the benefit of the funds internal diversification in the form of a smoother fund return and the diversification return achieved in the fund and inured to its investors. In an index fund or other passive strategy, there is no diversification return. (because this requires re-optimization or rebalancing). However, this is likely much less of a diversification return an investor can get if they rebalanced on their own or used Portfolio Thinktank’s re-optimization engine. But since you do not control the fund, you do not dictate when and how it is rebalanced so you only get some of the diversification benefit, not the actual diversification. Most funds are rather capricious about rebalancing and never re-optimize so their diversification alpha yield falls way short of what you can achieve by yourself.

100% of the diversification you do not get is the diversification lost in assembling your own portfolio. If you are assembling a portfolio of funds and you are suffering from the high correlations caused by averaging out all the idiosyncratic performance then you get no diversification and a small fraction of the total diversification benefit that you could have achieved.

For a better understanding on the potential benefit of diversification please see this snippet:

“Crucially, the Diversification Weighted 500 produced 652 bps of alpha per year on average for more than 18 years. The alpha for the five-factor model is 414 bps.”

I think it is reasonable to believe that the preponderance of the 4.14% of incremental returns every year is a function of fully exploiting the power of diversification.

Taken from our research Published in the Journal of Indicies are recreated on our website here.

Of course, this portfolio held too many assets, so it would be easy to improve upon, at least from a diversification return / diversification alpha perspective. If you are interested in the strategies to harvest diversification alpha, subscribe to Portfoliothink on YouTube, as I will be posted how to and strategy links for those.

So if you are the client of a Financial Advisor and you have a version of one of their model portfolios and the model portfolio is investing in other funds now you have 4 problems:

- Paying the advisor

- Additional fund expenses

- Lack of control

- Lack of diversification

These cumulatively provide that the strategy will be probably underachieving its potential by several percentage points every year. For more details on the problems with model portfolios, please see https://portfoliothinktank.com/model-portfolio/

The bottom line is that you can’t trust the industry to get you diversification. You can’t trust the industry to make diversification work for you. You can measure your portfolio diversification when you put in your portfolio at www.PortfolioThinkTank.com. And you can wire it in to your strategy if you use our free portfolio optimizer. See for yourself.

James’ professional orientation points at the zenith (and sometimes nadir) where technology and investments intersect. He is a Fintech entrepreneur and has served twenty years of a lifetime sentence.

James is a patented inventor, quant pioneer and investment manager. He is the founder of Gravity Investments, a unique investment and technology services firm centered on James’ inventions for diversification measurement, optimization, visualization, and analysis. In the development of the platform, James has pioneered A.I applications, diversification attribution, down-side diversification, portfolio re-optimization, full-lifecycle strategy optimization, programmable investment policy statements and core-satellite optimization techniques.

In working with advisors, funds and money managers as both a strategic sub-advisor and software consultant, James has consulted and trained hundreds of professional investors on portfolio design and optimization. James has a unique ability to look at any investment process and find practical, intelligent and often quantifiable opportunities to improve the investment product.

Inspired by the work of Nobel Laureate Harry Markowitz and the efficient frontier, James has championed and pioneered the science of diversification. James’ technology has advised

or assisted in over 30 Billion dollars of investor capital. His vision of a more perfect investment management system is at the heart of Gsphere ( www.gsphere.net )

His passion for performance, curiosity for the unknown, and drive to excel empower his service to investors.

James is Founder and CEO of Portfolio ThinkTank (the B2C company) www.portfoliothinktank.com, Founder & Chief of Financial Engineering at Gravity Investments www.gravityinvestments.com (the B2B company) and Chief Investment Officer at Gravity Capital Partners, a wholly owned SEC Registered Investment Advisor.