Just like Deion Sanders on the field, diversification goes both ways. Most investors intuit the benefit of defensive diversification, but diversification can play offense, too. The defensive ability of diversification to protect capital is a function of the non-correlation and is available to all investors in any strategy. Diversification as a proactive strategy is comparable to a rebalancing bonus. The sum of the defensive and offensive performance capabilities of diversification is what we call the Diversification Alpha™.

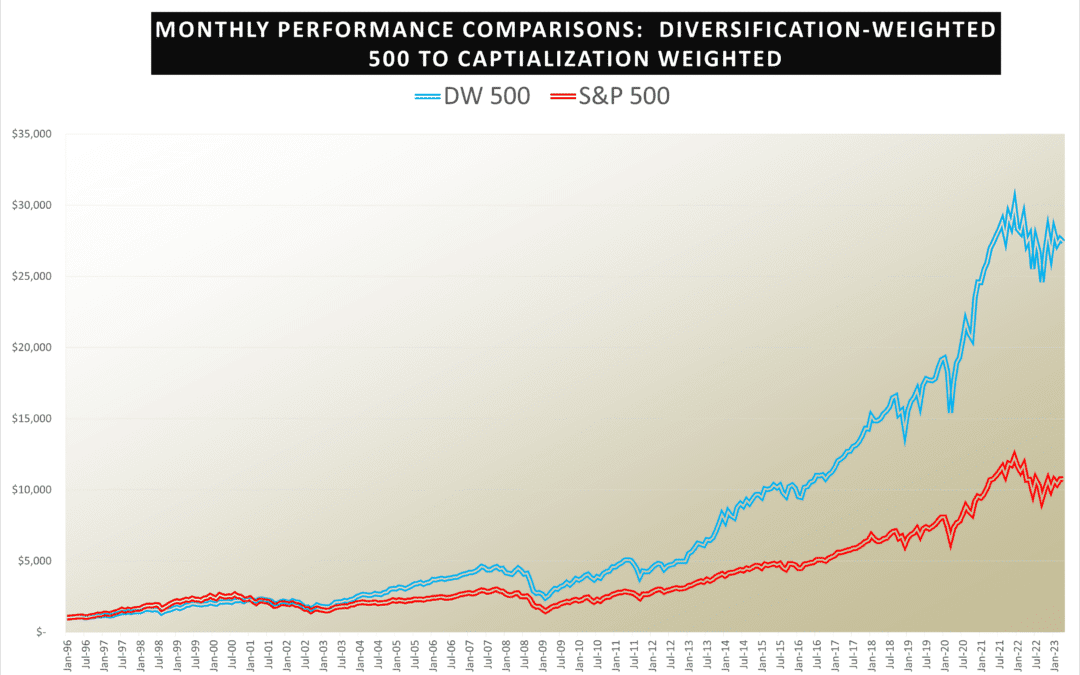

Let us look at the offensive side of it. The offensive capabilities of diversification can be substantial. This diversification ratchet is not available to all investors, as passive, buy and hold strategies such as capitalization or price-weighted indices cannot collect the alpha.

The alpha is made possible by exploiting diversification, volatility and some sort of trading activity, such as rebalancing but it can be other activity such as reconstitution or reoptimization. This trilogy of portfolio variables combines the idiosyncratic asset volatility to produce alpha.

More rebalancing, more diversification (non-correlation) and, contrary to MPT, more volatility, are all catalysts to increase this level of alpha. The affect is a veritable profits ratchet, which relates to Parrondo’s paradox (see Stutzer, The Paradox of Diversification (Stutzer, Spring, 2010)). This strategy is implemented at some large investment managers such as Parametric and Janus Intech. Our index construction technique enables a more efficient capture of the Diversification ratchet due to the optimization’s direct focus on diversification, and the unbundling of diversification from risk measurement.

The diversification ratchet is very similar to a rebalancing bonus; however, the ratchet is a more appropriate moniker because the alpha is available to investors without rebalancing at all. Other forms of portfolio activity produce the alpha; reconstitution, reoptimization, profit taking, stop loss, trimming, even dollar cost averaging. In all cases, the alpha requires diversification.

Portfolio managers get the defensive contribution of diversification whether or not they try to. The driver is the amount of non-correlation exploited. Diversification Returns and Asset Contributions (David Booth, June 1992) coined the term diversification returns and represents an additive portfolio return attributed to diversification. Booth & Fama approximated this as ½ the variance reduction in the portfolio given by diversification. The weighted average asset variance would be the portfolio variance if the correlations were all 1. For the most recent Diversification Weighted® 500, the weighted average asset variance is 9.35, corresponding to a standard deviation of 30.57%. The portfolio variance is 3.41%, corresponding to a standard deviation of 11.64%. The difference in variances, 5.94% when halved, provides a 2.97% annual diversification defensive return. Not bad.

. While the portfolio may claim a low variance the diversification return of 86 basis points is a fraction of the 297 basis point diversification return obtained by the DW 500. If your focus is variance and not correlation, it limits the amount of variance reduction and thus the Diversification Alpha.

. While the portfolio may claim a low variance the diversification return of 86 basis points is a fraction of the 297 basis point diversification return obtained by the DW 500. If your focus is variance and not correlation, it limits the amount of variance reduction and thus the Diversification Alpha.Maximizing Gains with Diversfication Returns and Diversification Alpha

The Diversification Alpha is the sum of the diversification return and the rebalancing bonus, or diversification ratchet. Gravity Capital Partners has Diversification Weighted separately managed accounts that are optimized around the production of the alpha.

James’ professional orientation points at the zenith (and sometimes nadir) where technology and investments intersect. He is a Fintech entrepreneur and has served twenty years of a lifetime sentence.

James is a patented inventor, quant pioneer and investment manager. He is the founder of Gravity Investments, a unique investment and technology services firm centered on James’ inventions for diversification measurement, optimization, visualization, and analysis. In the development of the platform, James has pioneered A.I applications, diversification attribution, down-side diversification, portfolio re-optimization, full-lifecycle strategy optimization, programmable investment policy statements and core-satellite optimization techniques.

In working with advisors, funds and money managers as both a strategic sub-advisor and software consultant, James has consulted and trained hundreds of professional investors on portfolio design and optimization. James has a unique ability to look at any investment process and find practical, intelligent and often quantifiable opportunities to improve the investment product.

Inspired by the work of Nobel Laureate Harry Markowitz and the efficient frontier, James has championed and pioneered the science of diversification. James’ technology has advised

or assisted in over 30 Billion dollars of investor capital. His vision of a more perfect investment management system is at the heart of Gsphere ( www.gsphere.net )

His passion for performance, curiosity for the unknown, and drive to excel empower his service to investors.

James is Founder and CEO of Portfolio ThinkTank (the B2C company) www.portfoliothinktank.com, Founder & Chief of Financial Engineering at Gravity Investments www.gravityinvestments.com (the B2B company) and Chief Investment Officer at Gravity Capital Partners, a wholly owned SEC Registered Investment Advisor.