PORTFOLIO BACKTESTING

WITH NO LIMITS

PORTFOLIO BACKTESTING

WITH NO LIMITS

A simple 5 step guided process based on your choices

Design your portfolio

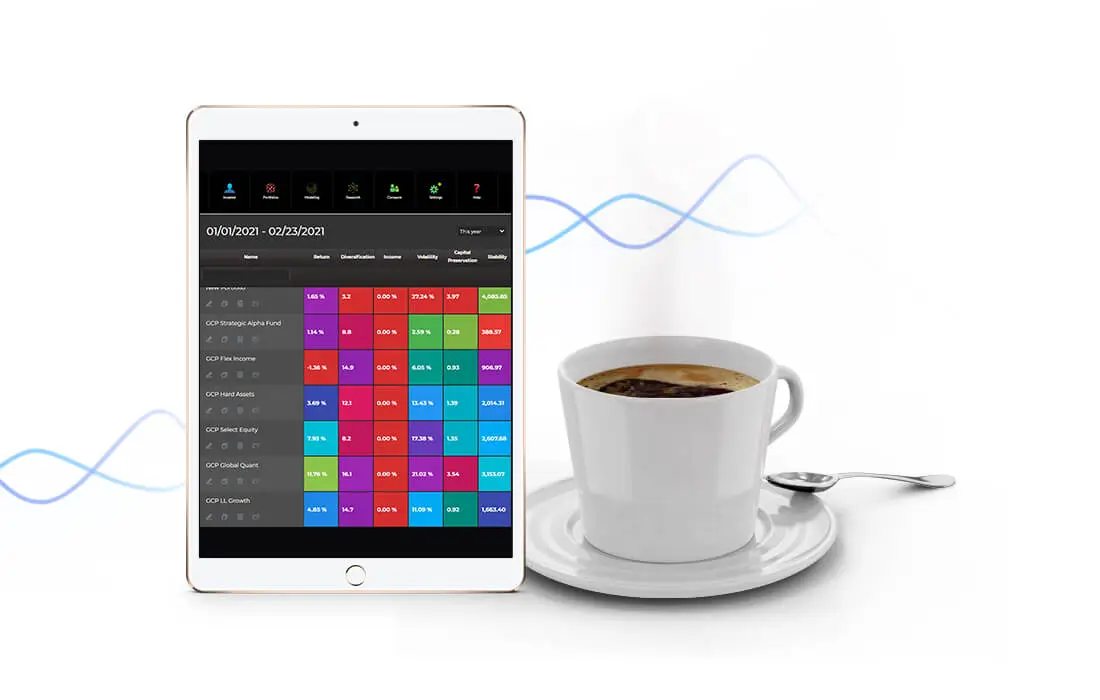

Analyze your portfolio backtest report and test any variations until your are satisfied

Fund your account and take your new strategy live… or just watch and see how the portfolio does

Sit back and let Portfolio ThinkTank provide anonymous, validated, contextual and optimal suggestions to improve your portfolio

22 ways your choices can help you succeed

Diversification

Your portfolio is optimized using our patented Diversification Optimization.

A Systematic Process

Personalization

We regularly update our investment themes and the assets inside them to give you opportunities to invest in things that can produce performance.

Prediction

Our predictions are always based on the latest fundamental, technical, social and pricing data. Never stale, like forecasts in some portfolio managers models portfolios.

OPTIMIZATION

Your portfolio is regularly re-optimized ensuring that you are loaded up with updated assets and predictions and the best assets allocation for your money now. Most portfolio managers just optimize a portfolio once then keep rebalancing it. Diversification is a moving target. We help you hit the target..

Your portfolio is rebalanced. Portfolio rebalancing combines diversification and volatility to create incremental returns known as a rebalancing bonus.

EFFICIENCY

We overfeed the system ideas to allow the system to cherry-pick the best subset of assets that meets your objectives, this lets the portfolio operate more efficiently.

MINIMIZING EXPENSES

Whenever possible we use individual stocks instead of funds. This removes the embedded fees of funds and greatly improves diversification.

We partner with Interactive Brokers which offers some of the lowest commissions in the industry.

WE ARE A FIDUCIARY

We don’t sell our orders to market makers who take the opposite side.

We have no conflicts of interest or products to sell.

We get up every morning obsessed with improving investment performance.