YOLO Stock Investing:

First, if you are in a YOLO investment – good luck.

It takes courage. Some of the recent payoffs have been huge, but success may not be as likely as you think. Most professional investors seem to mock or chastise WSB investors. I’m just here to share a few things that might help you learn from my mistakes and lost profits.

This page is just to help you. The Optimize my Portfolio button will take you in a different direction if you are having second thoughts, or hopefully, your YOLO paid off and you are ready for your next evolution.

There has been a saying around on Wall Street for generations:

“Bulls make money, Bears make money. Pigs get slaughtered”

You, sir, are a pig. I hope you can get fattened up before escaping the slaughterhouse.

Realize that you are on borrowed time.

Your brain is working against you.

Losses hurt more than gains heal. This is a core tenet of behavioral finance. This causes investors to fail to take gains and be too quick to realize losses. (to end the pain) It’s been a long-studied and well-known tenet of investor psychology or behavioral psychology that investors feel the sting of losses three times more than the joy or happiness they get from their wins. In a YOLO bet, some investors could be wiped out. Less experienced investors may not have fully contemplated this before entering the trade. If your bet fails and you incur substantial losses, you might need a little time to get your head right. In my career, I’ve noticed both gains and losses tend to auto-correlate (lump together). So after a nasty loss, you want to take a break from trading.

You might also want to understand that the four stages of grieving might apply to you. Money is important to everyone, so losing a big bet can have a real psychological impact.

- Denial. (blaming them—market makers, politicians, boomers, etc.)

- Anger. (I’m going to sue!)

- Bargaining. (Well, if I do this, then maybe I could get my money back.)

- Depression. (Fuck, that sucks; maybe I should give up.)

- Acceptance. (OK. I took a hit. Fuck it. I have moved on.)

An Awareness of this might help you speed through.

Chances are your bet is out there fully exposed.

Protect it by installing rules.

Traders develop trading rules and systematize their processes to guard against the persistent hazards of investor psychology. You do not have to throw out the rulebook to make a YOLO investment….and you don’t have to stick with it because you posted it on Reddit.

My First YOLO

My first degenerate YOLO idea came back in 1999. After college, I went straight to the trading floors in Chicago, principally because I was attracted by the leverage offered in the futures market and liked the relative simplicity of supply and demand of a few dozen currencies, commodities and stock market indices. The CME was my grad school, plus instead of paying tuition, I got a paycheck. The floor was a lot of fun, and WSB reminds me of the feeling of being there.

At one point early in my career, despite being a successful scalper and using the advantages of presence (sight, sound, energy, and tension) on the futures trading floor to spot intraday investment opportunities for my customers, I wanted to find something more scalable so I wouldn’t have to cold call doctors and dentists after the bell.

My company let me put up a campaign on the website where I was pitching that Y2K fears would lead to a short-covering rally in the gold market, and investors could put up big returns on far-out-of-the-money gold options.

I bought $300 / oz gold calls when gold traded at $220 oz with single-digit volatility. Despite some aggravation and even an interim loss of faith, the campaign worked—all of my investors made several times their money.

Call it beginner’s luck.

That was in 1999. Now, with weekly call options, your YOLO prayers can be answered on any given Friday. With all of that Yolo investment opportunity, it’s hard not to be tempted.

I am afraid that the odds are probably stacked against you.

The Greater Fool Theory

All assets, including tulips, NFT’s, Crypto-currencies and stocks are worth just what the next person is willing to pay for them. This is true of your home, your GME stock, your TSLA stock options, or the t-shirt on your back. Many of the top memes on the Reddit WSB sub are terrible investments.

You know this, right?

Of course, terrible investments can still make great trades, but for your trade to work, there must be enough people who see it as you see it after you’ve seen it. And you need an exit strategy so you’re not left as the bag-holder.

I joined WSB about 6 months ago. (authored in November 2020) There were under 1 million members, and the number of people buying FDs (weekly expiring call options) was 10,000–30,000. One month ago, WSB had 2 million members. Last week, WSB had 4 million members and 700,000 buying FDs. Yesterday, it had 8 million degenerates. The supply of follow-on buyers has been growing. It won’t last. Think musical chairs.

If you are betting that the WSB Army will push the stock,

do you have quantitative evidence of that?

Are you early enough on the trend?

Gordon Gecko is happy to remind you of the fate of sheep

<iframe width=”560″ height=”315″ src=”https://www.youtube.com/embed/-TLCaDbBv_s?si=Bt5dxrC3ZIgH4dmg” title=”YouTube video player” frameborder=”0″ allow=”accelerometer; autoplay; clipboard-write; encrypted-media; gyroscope; picture-in-picture; web-share” referrerpolicy=”strict-origin-when-cross-origin” allowfullscreen></iframe>

Divine and Spiritual Dimensions

There’s an abundance of stories of lottery winners and ball players who create tremendous fortunes and then find themselves broke in a remarkably short period thereafter. There is a quote in the Bible:

Matthew 13:12

Whoever has will be given more, and he will have an abundance. Whoever does not have, even what he has, will be taken away from him.

If you are YOLOing out of desperation, then you have already assumed the identity of the person without it, and you are manifesting that reality with one YOLO trade.

Consider if you are in good standing with the Lord.

My Conversation with Warren Buffett

I’ve never spoken with Warren Buffett. Well, sort of.

Early in my career, I recall a day that was unspectacular in most ways, but on a curious note, I recall that Warren Buffett was speaking on television. Surely, owing to some sort of psychosis, I formed a question in my head targeted at Mr. Buffett. I had asked that if I liked this stock so much and thought it was going to be $80 a share, then why not just get some out-of-money call options that would maximize the payoff should my hypothesis prove correct? At that moment, Warren Buffett paused, and then he stated -as clear as day- that it would be “overreaching.” I don’t know what the hell Warren was actually talking about, but I do know I had some sort of divinely inspired answer to my question.

Of course, as a fellow YOLO degenerate, I would have to find this lesson out the hard way. Now, 20 years later, I can tell you that it’s fair to say most of my worst losses have not been simply bad choices but of overreaching.

Author, doctor, and new-age philosopher Joe Dispenza says that the universe will only deliver what you believe you are worthy to receive. Perhaps the frequent failure of overreaching is of this nature.

The challenge of overreaching can also be observed in a chart of risk and return, like the efficient frontier. This shows the hypothetical trade off of risk and return and it correctly illustrates that more and more risky bets must be taken to produces a marginally bigger return. It is a diminishing return.

How to YOLO

I get the allure of rapid, life-changing money—who doesn’t? As I am writing this today, my trading account is up about 40% in two days (I am now editing this after losing 23% yesterday). I’m not gloating, but I want you to know that I’m one of you. However, the gambles that i like to take on occasion in my personal account teach me lessons including the idea that prudence is more provident than prosaic.

140 years ago, when the stock exchange was outside on the curb, they used to call us plungers. Big dick bets. Some things never change. WSB

I strongly advise against putting everything into one idea. If you do, please research Fortunes Formula, a.k.a. the Kelly Criterion, which is an optimal bet sizing algorithm under a no-diversification scenario.

For fucksake, you can YOLO without putting it all on one f****** stock, not telling you you need to be so diversified to make the bank trustee happy, but you can still do two or three things and pull a YOLO.

If you take my advice on this, you should ideally find uncorrelated assets.

- Something long,

- Something short. (calls and puts)

- Different stocks

- Different sectors

- Different time horizons

- Different countries

- Different narratives

Each of these represents a dimension of diversification.

But not in this case.

This situation

- High-risk,

- High-return,

- Big dick trade

This is where diversification truly delivers.

The importance of Capital Preservation

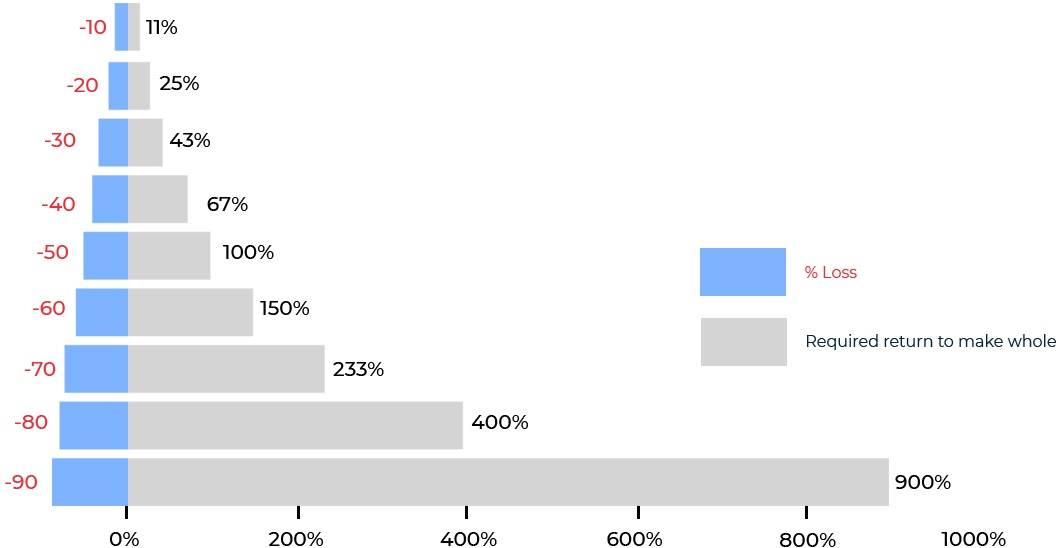

Imagine that you go all in on weekly OTM call options. If you lose, you’re done. A 99% loss requires a 1000% return just to break even! This asymmetry is the price we pay for the miracle of compound interest.

Be a Pro.

Just cuz you’re a degenerate doesn’t mean you can’t be professional. I don’t mean working inside Financial Services, but it may be smart to take on a few attributes of a professional investor.

Investment professionals are fiduciaries when they manage other people’s money. A fiduciary is a simple yet profound word, which means that they must put the interests of their clients ahead of their own interests. Commission-oriented Brokers such as UBS and Robinhood are not fiduciaries. Broker dealers make their money when you buy and sell, especially when you buy and sell special products, like crypto, hedge funds, insurance or structured notes.

Typically, only Investment Advisors and Trustees are fiduciaries.

Part of being a fiduciary is that an investor must consider both the risks and the rewards before investing. Have you thought of the risks of your position? I suggest you write them down.

This little exercise is a miracle worker and has saved me from many investments that looked great on the surface but cannot survive real due diligence (DD).

Taking profits is a grossly underserved area of investments and academic research. Having standing limit orders on highly volatile positions can change your fortunes.

How to pick your YOLO ideas.

This is too big a topic for this post, but don’t be the bag holder; if WSB is saturated with memes about your Yolo idea, chances are you’re too late.

Don’t be swayed by other artists.

Be original. Do your own DD, mind your execution, put your position on, and then you can share it in WSB.

If you are buying FDs, consider buying something somewhat in the money. This way, if you lose, you don’t lose it all. Live to fight another day.

If you’re going to buy call options, you should probably know how expensive they are. When you strip out the time value and distance from strike to the current price, it is really the Implied Volatility of an option that you can think of as the price. I love options, but honestly most of the time I like the idea of executing a trade with options, i look at the implied volatility and must conclude that it is too expensive and do not trade it. Too much can go wrong. Which is another reason why, when i do find a highly leveraged trade that i like, i never – ever consider risking more than 1/3. In a professionally advised and optimized portfolio that curiously tends towards a max value too, but more common is something like 15%. Remember, the more you have, the more you have to lose.

You can also get the implied volatility from the Traders Workstation (TWS) by Interactive Brokers. Here is my sign-up page for an IB account, which is currently my go-to broker advisory agreement.

Do the Math

First, no judgments here. Good luck.

But most investors should not YOLO-vest. (I just made that up!). In rare cases, for those needing a huge return in a specific period wherein the utility of wealth in a success scenario far exceeds the lost utility of a total loss by more than the probability of a successful outcome, then ok.

Consider incorporating some high-risk-high return bets into your Investment Strategy

A diversified portfolio of such bets can be a wonderful strategy (provided that the securities selected are accurately assessed for their risk and return potential). This is incredibly difficult, but yet we play the game.

Becoming rich is a journey, and I encourage you to embrace the journey.

About me

However, nothing in this note should be construed as investment advice, as I do not offer investment advice without an executed advisory contract. For a regulator, investment advice must be personal, ongoing, and for a fee. I provide digital investment advice through software here when you use the portfolio designer behind the big red button.

See Lisa’s investment journey and her decision to take control of her investment portfolio.

Frequently Asked Questions

What is YOLO?

Yolo is an acronym for You Only Live Once. When applied to investments and trading, this has come to mean outsized bets for life-changing money. It is one of the most risky strategies in existence.

What is an WSB?

Wall Street Bets, an online forum, or Channel Subred, of the tech firm Reddit. Users share their experience with placing large stock market wagers.

What is a Fiduciary?

Investment professionals are fiduciaries when they manage other people’s money. A fiduciary is a simple yet profound word, which means that they have to put the interests of their clients ahead of their own interests. You have to pay them to do this.

Commission-oriented Brokers such as Robin Hood or Charles Schwab are not fiduciaries.

Typically, only investment advisors and trustees are fiduciaries.

Part of being a fiduciary is that an investor must consider both the risks and the rewards before investing. Fiduciaries must exercise skill and prudence, and fiduciaries must diversify.

What is Overreaching?

To defeat (oneself) by seeking to do or gain too much.

Get an Alternative for Yolo Investment

Changing from a narrow trading perspective to more holistic portfolio-level thinking is a hallmark of successful and sophisticated investors.