You need to restructure your Conservative Investment Portfolio, especially if it’s bond-heavy, due to the increasing risk and likelihood of rising inflation.

Cutting your fixed income exposure in half is a good starting point.

It’s likely that your conception of risk fails to account, in whole or in part, of the risk of inflation eroding the future purchasing power of your assets.

It’s hard for me to imagine a case for any portfolio right now to be over 50% fixed income. I don’t care if you are 90 years old or if you are CIO for an insurance company. There is a better way to build a conservative portfolio.

If you have such a portfolio I urge you to restructure it. I will show you how.

Why is a change needed?

First of all, yield to maturity rates on most fixed income instruments will not keep up with inflation.

This means that owning heavy fixed income portfolios will be losing money relative to the cost of living.

Do you know what your portfolio is actually yielding? Chances are, That it is not too great. The popular ETF; AGG which tracks the Bloomberg Barclays U.S. Aggregate Bond Index now yields 2.14 %. Also, chances are, that your bond yield is not far in excess of the dividend yield you could achieve on a stock market portfolio, while keeping some appreciation upside.

I believe that most measures of inflation are structurally mis-engineered and understate actual inflation rate.

The Federal Reserve is deliberately stoking inflation, and will shamelessly utilize their full tool set until they see inflation rise and until inflation substantially overshoots the 2% mark, as judged by the Consumer Price Index (CPI).

The Federal Reserve is not the independent institution it would have you believe it to be. The Federal Reserve works in concert with the money center banks and the US Federal Government and they want to make it easier to pay back the debt that our government is in. officially, their mandate is economic growth and price stability. The mere fact that they read price stability as prices should go up 2% every year is prima facie evidence of their true intentions. Here is some perspective on the growth in M1, the more narrow measure of money, and mostly in the control of the government.

source: tradingeconomics.com

We are in the midst of a global currency war.

Safeguard your wealth with a Conservative Investment Portfolio

This just means that most nations wish to reduce the value of their currency relative to others so they can sell more goods and services to the rest of the world. The strategy only works when some of the countries want their currency higher and some countries want rates lower. Currently, nearly all developed nations wish their currencies to go lower. You can see the proof for this amidst the constantly inflating money supply and low interest rates around the globe.

I like the Economist for a quick scan on global rates:

Instead of utilizing low-risk, low-yielding instruments to make your portfolio safe and protect and preserve its capital, I want to show you a path where using greater diversification – validated, measured and verified – can be the instrument to reduce the risk of your portfolio. This lets you take more chances on individual positions without over risking the portfolio.

Let diversification manage your portfolios risk instead of investing in low returning investments.

The catch is – You have to have good diversification. Real diversification. Definitely not Fake diversification.

Comparing a portfolio of strongly diversified, well-sourced investment ideas, especially when combined with the reoptimization rebalancing strategy should be comparable by most risk measurements to your old fixed-income portfolio with significantly greater as-modeled and, more importantly, realized future returns.

Here’s a refresher with some basic economics:

Owning a fixed income (bonds) instrument entitles you to a schedule of fixed future payments.

If inflation increases, your fixed schedule of future cash flows still does not change, it just becomes worth less.

This reduction in worth will decrease the prices of those bonds impacting the current value of the instruments in your portfolio for all assets not held to maturity.

We’ve seen technologically-induced productivity deliver powerful powerful deflationary pressures for so long. (BTW; I recommend Jeff Booth’s book on this topic: https://smile.amazon.com/Price-Tomorrow-Deflation-Abundant-Future/dp/B08725C857/ref=sr_1_1?crid=20TIB5EV1E2OB&dchild=1&keywords=jeff+booth+price+of+tomorrow&qid=1620075375&sprefix=jeff+booth%2Caps%2C234&sr=8-1

Why inflation? Why now? What’s the proof?

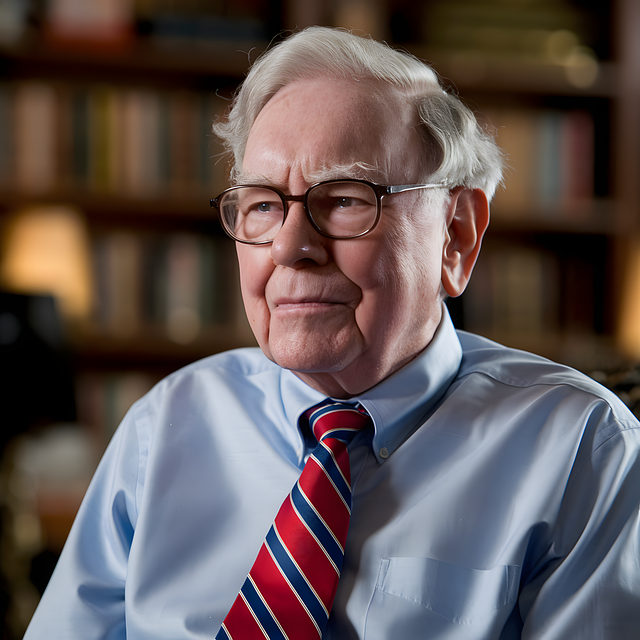

I give you the Oracle of Omaha….

2021 shareholder meeting…. Earlier today….

We’re seeing substantial inflation. We’re raising prices, people are raising prices to us. And it’s being accepted,” Buffett said. “We really do a lot of housing. The costs are just up, up, up. Steel costs. You know, just every day they’re going up.” –

“It’s an economy – really, it’s red hot.” – Warren Buffet

Let’s look at those Housing inputs:

Lumber + 331% Year over Year

https://finviz.com/futures_charts.ashx?p=d1&t=LB

Copper +95% year over year

https://finviz.com/futures_charts.ashx?t=HG&p=d1

Steel + 53% Year over year

https://tradingeconomics.com/commodity/steel

Land + 10% Year over year

https://www.zillow.com/home-values/

Labor + 4% Year over year

https://www.tradingview.com/symbols/FRED-ULCBS/

Many assets can perform well in an inflationary environment.

Among them, broadly here and more specific later:

- Precious metals

- Commodities

- Real estate

- Stocks

- Cryptocurrencies

Of course, there’s specific areas of the bond and stock market which will over or underperform during higher inflation.

In the bond market one could expect shorter dated securities to be a better store of value, And well that is basically always the case it would be especially the case in this environment.

Treasury Inflation Protected Securities (TIPS) Will be better. But this is not your salvation, just a portfolio holding.

TIPS – AGG

https://www.tradingview.com/symbols/spread/MIL%3ATIPS-AMEX%3AAGG/

Getting some yield from credit risk is probably a better place to find it versus going longer duration in the same asset class. This will not be the case when growth gives way.

As far as stocks goes, not all stocks are created equal for inflation. I prefer stocks with a simple supply chain, lower inventory businesses, service-based businesses, higher growth and higher margin businesses. Think what if inflation spiked would this company be left holding the bag or would they be able to pass the costs along fluidly and without disruption? Can they be easily substituted?

There’s a lot of other things that can work better.

Let’s profile out some ideas across the sectors:

- Utilities – yuck – I would expect significant resistance to repricing costs even with higher inputs.

- Financial – hold to overweight

- Energy – overweight but I don’t love the entry point here

- Healthcare – hold to overweight

- Technology – overweight

- Consumer staples – underweight to market weight

- Consumer cyclicals – hold

- Basic materials – overweight

- Real estate -overweight

- Telecommunications – complex supply chains and re-pricing resistance – underweight

- Industrials – Underweight

So without further ado here is a video i just made to create a portfolio that is low risk and designed to keep your money safe from inflation:

https://youtu.be/EqKDkiqDfnA

Design your own inflation protected portfolio here:

James’ professional orientation points at the zenith (and sometimes nadir) where technology and investments intersect. He is a Fintech entrepreneur and has served twenty years of a lifetime sentence.

James is a patented inventor, quant pioneer and investment manager. He is the founder of Gravity Investments, a unique investment and technology services firm centered on James’ inventions for diversification measurement, optimization, visualization, and analysis. In the development of the platform, James has pioneered A.I applications, diversification attribution, down-side diversification, portfolio re-optimization, full-lifecycle strategy optimization, programmable investment policy statements and core-satellite optimization techniques.

In working with advisors, funds and money managers as both a strategic sub-advisor and software consultant, James has consulted and trained hundreds of professional investors on portfolio design and optimization. James has a unique ability to look at any investment process and find practical, intelligent and often quantifiable opportunities to improve the investment product.

Inspired by the work of Nobel Laureate Harry Markowitz and the efficient frontier, James has championed and pioneered the science of diversification. James’ technology has advised

or assisted in over 30 Billion dollars of investor capital. His vision of a more perfect investment management system is at the heart of Gsphere ( www.gsphere.net )

His passion for performance, curiosity for the unknown, and drive to excel empower his service to investors.

James is Founder and CEO of Portfolio ThinkTank (the B2C company) www.portfoliothinktank.com, Founder & Chief of Financial Engineering at Gravity Investments www.gravityinvestments.com (the B2B company) and Chief Investment Officer at Gravity Capital Partners, a wholly owned SEC Registered Investment Advisor.