About

ThinkTank

Portfolio ThinkTank was born from the realization that most hands-on, active investors—smart people—still end up worse off than those who follow passive buy-and-hold investment strategies.

In most walks of life, trying harder and being smarter helps. But with investments, psychology is different; it is backwards. Investors have to battle both their emotions and the stock market. They buy high and sell low because it feels good to buy when something is popular. Buying something that nobody loves can be lonely, isolating, and uncomfortable. Investors need a safety net—a process that they can operate within. We are honored to be part of that process. So think About ThinkTank

The Enabling I.P and Technology Stack

Recommendation Engine

- Generative A.I. Contextual Recommendations

- Custom Priced and Revenue Sharing

- Push or Pull, API or GUI

Strategy Automation

- Flexible Use Cases & Programmable IPS

- Any Strategies or Asset Types

- Rules-Based Self Driving Money

Portfolio Backtesting

- Validation / Objectivity / Compliance

- Comparisons & Proposals, Analytics & Diagnostics

Re-Optimization

- Rules Engine, aka. The Policy Tree

- Full Lifecycle Portfolio Management

- High-End Workflows, Overlays

Science of Diversification

- Patented Measurement

- Patented Visualization, Patented Optimization

Portfolio ThinkTank protects investors from damaging investment psychology. Google “Behavioral Finance” if you want to learn more about it. Mastering an investor’s own emotions makes all the difference. When investors have a system, that system can provide the rules and structure that support them.

Most investment professionals know this, but instead of encouraging you to develop your system, they want to sell you theirs.

Honestly, your ideas are just as good as theirs. Now you can design and backtest your own portfolio strategy without needing technical expertise.

The founders of Portfolio ThinkTank have spent two decades helping investment managers and wealth managers craft better portfolio strategies. Now, it is time for individual investors to have access to the tools that the big investors use.

We have taken twenty years of fintech experience—during which we created outstanding systems for portfolio optimization, portfolio backtesting, portfolio analysis, and portfolio automation—and made it available for you to use, for free.

You can do this. We are here for you.

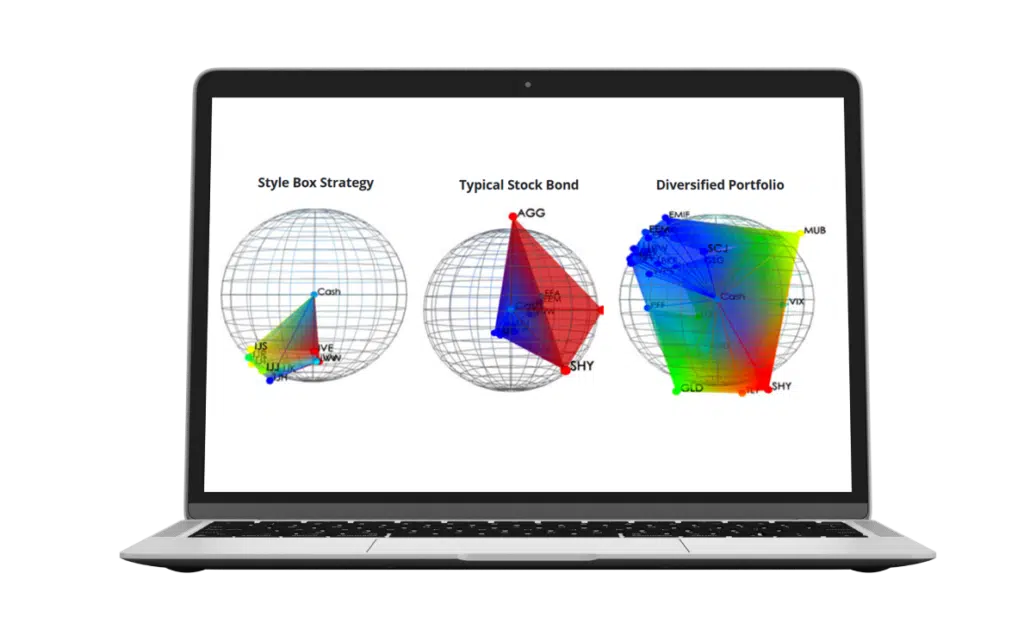

INVENTORS OF THE 3D PORTFOLIO VISUALIZATION

Portfolio Diversification is not eggs and baskets or vague flimflammery. It is a definitive science – and one the most predictable measures for portfolio analysis…but is it important? Find out here

Join as an Affiliate

10% Commissions for all first year revenue for all products

Import Screen Results with Copy and paste ticker extractor

90 day cookie expiration policy

Join as an Affiliate Partner

8.5% Annual Lifetime Revenue Share

No time limitations on conversions

Custom resources

Stock Screener Integration

Exclusive sponsorship of the screen results page

Ongoing marketing

Joint Promotions

Our Mission

Gravity’s mission is to Bring Life to Diversification: with our pioneering work in the science of diversification, we empower the industry’s knowledge and application of True Diversification. We execute our mission with custom systematic portfolio strategies delivered through our automated digital advice platform.

Our platform, constantly evolving and improving, is the ultimate performing digital advice platform; trusted throughout the industry for our leadership, integrity, service, and commitment to investor success.

– James Damschroder, Founder and CEO

History

WHY PARTNER WITH GRAVITY

Approximately $30 Billion has been professionally managed with our patented software as a service by our financial advisor and institutional wealth manager clientele using Gsphere Diversification Optimization™ portfolio technology. Our research-based Journal of Index, Legends of Indexing feature issue researched results generated over 400 basis points annually compared to the cap-weighted S&P 500.

Diversification Weighted® Strategies are systematic, quantitative, and replicable. Unlike other weighting approaches, we offer an inherent ability to work across all security instruments, asset classes, and investment strategies. Our patents and technologies for diversification measurement, visualization, search, and optimization are seminal and profound. Our holistic 3D portfolio visualizations (below) expose diversification deficiencies and drive demand for a balanced investment solution.

OUR VALUE PROPOSITIONS

Win new business

Attract new investors with our easy-to-embed tools for your website.

Compete and thrive in any opportunity

Diagnose any portfolio & find hidden risks. Then build objective, verifiably diversified portfolios that better serve investors.

Do right by your clients and be a better fiduciary

Nurture loyal clients, facilitate referrals and manage your fiduciary liability.

Expand and enterprise

Whenever you are ready, team up with Gravity to implement automated and optimized portfolios. Your choice: models or even custom-tailored accounts.

CORE VALUES

We strive to demonstrate our core values with every interaction. If you believe that your interaction fell short,

especially if it is me, please let me know– James Damschroder (@) gravityinvestments.com