Time to Evolve

Asset Allocation

Asset allocation needs revision. In the world of reconstruction, re-marketing and reselling, repurposing, redirecting, and rethinking, it seems obvious that our most sophisticated and complicated decision-making is subject to multiple or continuous iterations.

Multiple iterations allow for adaptation and the refinement (pun intended) of the original process. This process of multiple iterations is like our own evolutionary heritage. As humans we are constantly learning. The adaptation and evolution of mankind is paramount to our survival.

“It is not the strongest of the species that survives, nor the most intelligent that survives. It is the one that is most adaptable to change.”

set an asset allocation conforming to the risk profile of the investor,

select products to meet the categories of the asset allocation

Yawn. In a world where fiduciary standards and fee pressure have advisers justifying their value this asset allocation modality feels dubious.

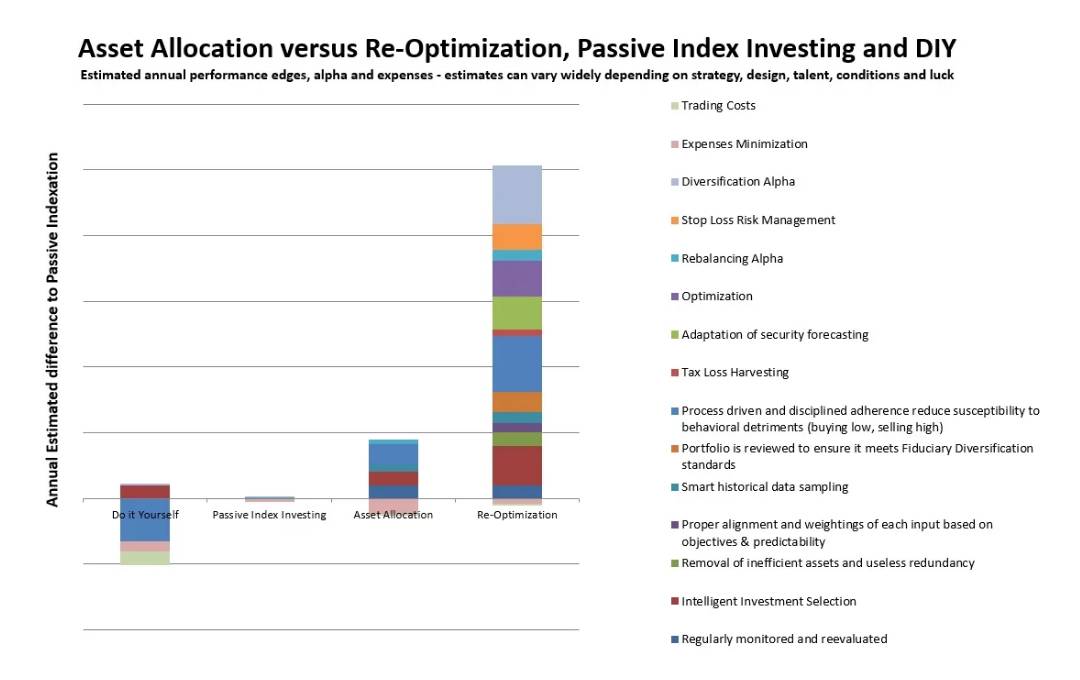

Let’s break this down. Optimization is simply asset allocation executed with scientific rigor and exhibiting some form of efficiency. There are several forms of optimization, mean-variance optimization invented by Harry Markowitz is the most well known. We have invented Diversification Optimization. In any case, the gain of optimization over an unscientific process can be substantial, due the the injections of several value-added performance edges. Whatever your flavor of optimization, the next step in the evolution of the portfolio management process is to design the process so the optimization logic is regularly applied. We call this Re-Optimization.

Re-Optimization must be systematically applied. In doing so, we can use systematic diversification to make the hard decisions and bankroll some of the excess idiosyncratic volatility generated by emotion-based traders and actors. This can be several points. My guess is that the real reason why most professional active managers fail to beat the market is that they succumb to the same behavioral finance pitfalls that derails most individual investors. There are powerful forces at work here and the pro’s are not immune. I am reminded of Warren Buffett, “Be fearful when others are greedy and greedy when others are fearful.” Good advice. The systematic institution of good advice ensure that it is actually taken.

When you redesign you don’t make it look the way it first looked you make it look better.

Macroeconomic conditions and the location of the point in time in the economic cycle should affect asset allocation. There’s a well-observed and largely consistent momentum effect studied across stocks. This has had easily the highest payoff over the last few decades of any of the factors. This momentum effect can be applied to any asset class. Take a look on the Federal Reserve site for any major economic series over decades.

These are not random. Asset relationships sometimes drift together and sometimes drift apart. The assets that provided good diversification in 2013 are not the same as the assets that provided diversification in 2018. It is a moving target. As any duck hunter knows, your best chance to hit a moving target is to move with it.

We believe that researched, documented and tested performance edges can improve most strategies.

There is nothing wrong with asset allocation. It is just incomplete. Asset allocation when created with smart optimization is a good step, but reimaging the portfolio construction to account for dynamic market conditions and stock selections from the beginning with a re-optimization strategy we think completes the story.