Strategic Tech Stock Allocations for Optimal Investment Growth

Proper Portfolio Construction is both art and science. Here is a little art.

Why you should constrain all of your sectors except technology?

What are portfolio constraints?

Position constraints are a popular input to portfolio optimizers or asset allocation software. For those investors investing directly into stocks, sectors can make for sensible group constraint. So why should technology be treated special?

When doing a portfolio optimization or asset allocation it can often be advisable to apply some sort of sector constraints. My clients often take the market weights of the sectors and apply some multiple to them as the minimum and maximum sector constraint. For example, if Healthcare represents 20% of the market, we could put a band on the health care allocations between 10 and 30%…. that’s just the 20% Market weight plus or minus 10%. Our customers use these sector constraints to better tie the portfolio performance to benchmarks. This is more important for professional investors who might get fired when benchmark-hawking investors wonder why they are underperforming the index. In this case, it’s usually a business decision not an investment decision.

But there are good reasons to use constraints:

Constraints are also used to force some allocations to deeply out of favor investments or themes which often prove to be beneficial; in the form of diversification and discipline. In other strategies, aspects of the forecasting or selection process can overweight some portfolio holdings in certain sectors. This is probably the best reason for imposing sector constraints: it becomes a counterbalance to other imbalances created as part of the investment process.

Most data providers have a similar view on sectors, using the Standard Industry Classification (SIC) as adopted by Standard & Poor’s we get the following sectors:

- Healthcare

- Financial

- Energy

- Communication Services

- Consumer Staples

- Consumer Discretionary

- Utilities

- Information Technology

- Real Estate

- Industrials

If you want to dive in on sectors this is a decent resource: Global Industry Classification Standard

These classifications aren’t exactly perfect. But they are alright. Industry groups do a much better job of delineating business strategies amongst the classification groups, however they also tend to be too granular as a portfolio optimization input unless a portfolio intends to own hundreds of issues, or is taking concentrated bets in a few specific industries and wants to maintain available diversification.

The financial, real estate and consumer discretionary sectors are all what’s called cyclical sectors and tied to the macroeconomic cycle in the form of interest rates. These underlying commonalities can spark risk, signal the loss of diversification and warrant the application of constraints. For example, I have executed many stock screens in which the plurality of stocks matching the stock screen requirements are all financial stocks. Rather than accept this tilted portfolio, I adjust the screen to allow more stocks in, sufficient to enable a minimum portfolio constraint match by stocks of all sectors. Sometimes acting with such prudence feels like leaving money on the table, but in this case, the profits and the prudence are aligned.

Consumer Staples and utilities tend to be low growth, lower margin, commoditized businesses. Often, supported by paying attractive dividend yields; these sectors can be more defensive; an attribute coming at the expense of growth potential. These sectors can trade in and out of favor

The energy sector is driven principally by the production of oil and associated fossil fuels. Here in the spring of 2020, investors are acutely aware of the volatile potential of an asset class that hinges on the price of a single commodity. That homogenizing factor increases risk and fortifies the decision to constraint the sector weight.

That only leaves us with Healthcare, Communication services and Information Technology.

Communication Services warrants a constraint because the sector is so narrow. I feel it should be rolled into Information Technology as its own Industry Group. Failing to constrain this sector can provide out sized allocations to just a few of the assets in the sector and create undue idiosyncratic risk.

This brings us to Healthcare and Information Technology.

The Healthcare sector is entering a secular bull market commensurate with the aging population of the United States as well as additional Information Technology catalysts. I will not lobby for you to apply a maximum constraint to the sector. However a minimum constraint would seem to be appropriate. Nonetheless a sector model weight of some multiple of the sector market weight is wise. The health case sector is subject to political risks, currency risks and demographic risks. While it appears that these risks are tailwinds at the moment. My hope is that you will keep with the discipline of using sector constraints long after you have forgotten this post and even long after the healthcare tailwinds turnabout.

Information Technology to me is really less of a sector into itself and more of the Innovation dimension of all other sectors. You can make the case that it is a sector unto itself but virtually all software companies irrespective of any industry exclusivity are not categorized by the industry that they are serving, but rather as an IT company. Therefore it sort of represents the growth and innovation sub-sector across all industries. Wouldn’t it stand to reason then that industries that are suffering from lack of innovation might be especially ripe to have a fast-moving and innovative technology-based competitor come in and take market share?

I think the recent out-performance of QQQ over SPY since COVID-19 hit is further evidence. COVID-19 is accelerating the move to the cloud and hurting business having physical presence, such as restaurants and retail. In fact, in recent weeks I have heard many investors and reporters refer to the major tech stocks as haven stocks. Haven is short for safe-haven. A safe haven stock used to be a stock with an attractive valuation, attractive margins and fundamentals and a reliable dividend. Now in a world where any company’s tenure in the S&P 500 index is shorter than its ever been, haven means the ability to survive the unexpected. Maybe this is a case where the best defense is a good offense.

So whether you chalk it up to a mis-classification or perhaps just the absence of homogenizing risk factors consider skipping the maximum constraint on your IT sector on your next portfolio optimization.

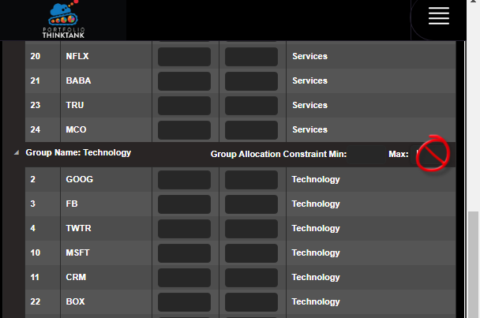

Users of professional optimization can customize individual sector constraints.

Let me know what you think.

James’ professional orientation points at the zenith (and sometimes nadir) where technology and investments intersect. He is a Fintech entrepreneur and has served twenty years of a lifetime sentence.

James is a patented inventor, quant pioneer and investment manager. He is the founder of Gravity Investments, a unique investment and technology services firm centered on James’ inventions for diversification measurement, optimization, visualization, and analysis. In the development of the platform, James has pioneered A.I applications, diversification attribution, down-side diversification, portfolio re-optimization, full-lifecycle strategy optimization, programmable investment policy statements and core-satellite optimization techniques.

In working with advisors, funds and money managers as both a strategic sub-advisor and software consultant, James has consulted and trained hundreds of professional investors on portfolio design and optimization. James has a unique ability to look at any investment process and find practical, intelligent and often quantifiable opportunities to improve the investment product.

Inspired by the work of Nobel Laureate Harry Markowitz and the efficient frontier, James has championed and pioneered the science of diversification. James’ technology has advised

or assisted in over 30 Billion dollars of investor capital. His vision of a more perfect investment management system is at the heart of Gsphere ( www.gsphere.net )

His passion for performance, curiosity for the unknown, and drive to excel empower his service to investors.

James is Founder and CEO of Portfolio ThinkTank (the B2C company) www.portfoliothinktank.com, Founder & Chief of Financial Engineering at Gravity Investments www.gravityinvestments.com (the B2B company) and Chief Investment Officer at Gravity Capital Partners, a wholly owned SEC Registered Investment Advisor.