An Investment Policy Statement is a collection of policies that institutions used to use to govern how their portfolios where managed. They still do. Some Investors use this to, usually very wealthy investors. Portfolio ThinkTank has taken the IPS and combined it with automation, optimization and backtesting to help any investor create a truly custom portfolio strategy that is theirs. Also – its’ free! Here I give the top 10 reasons that you should create your own Investment Policy Statement (IPS). Lots of advisor’s won’t do this with their investors – it’s too much work and many advisors don’t have the software tools necessary to enable investors to create custom strategies. As you read the list below think how each idea could benefit you and your family.

-

- Clarity of goals: An IPS provides a clear and concrete set of investment goals that can be used to guide investment decisions.

- Risk management: An IPS can help to identify and manage risk by outlining the types of investments that are appropriate given the investor’s risk tolerance, and by providing guidelines for diversifying the portfolio.

- Consistency: An IPS provides a consistent framework for making investment decisions, which can help to reduce the impact of emotions and cognitive biases on decision-making.

- Flexibility: An IPS can be easily adapted as the investor’s goals, risk tolerance, or market conditions change.

- Transparency: An IPS provides a clear and transparent record of the investment strategy, making it easy for the investor, their financial advisor or other fiduciary to understand and evaluate performance.

- Improving discipline: An IPS can help an investor to stay disciplined by providing a set of clear rules and guidelines to follow when making investment decisions

- Better communication: An IPS can facilitate better communication between the investor and their financial advisor or other fiduciary by providing a clear understanding of the investment strategy and goals.

- Benchmarking: An IPS can be used to benchmark the performance of the portfolio against the stated goals and objectives.

- Alignment: An IPS can align the investor’s values and beliefs with their investments

- Legal protection: An IPS can be used to hold fiduciaries accountable for their role in following the instructions set forth in the policies.

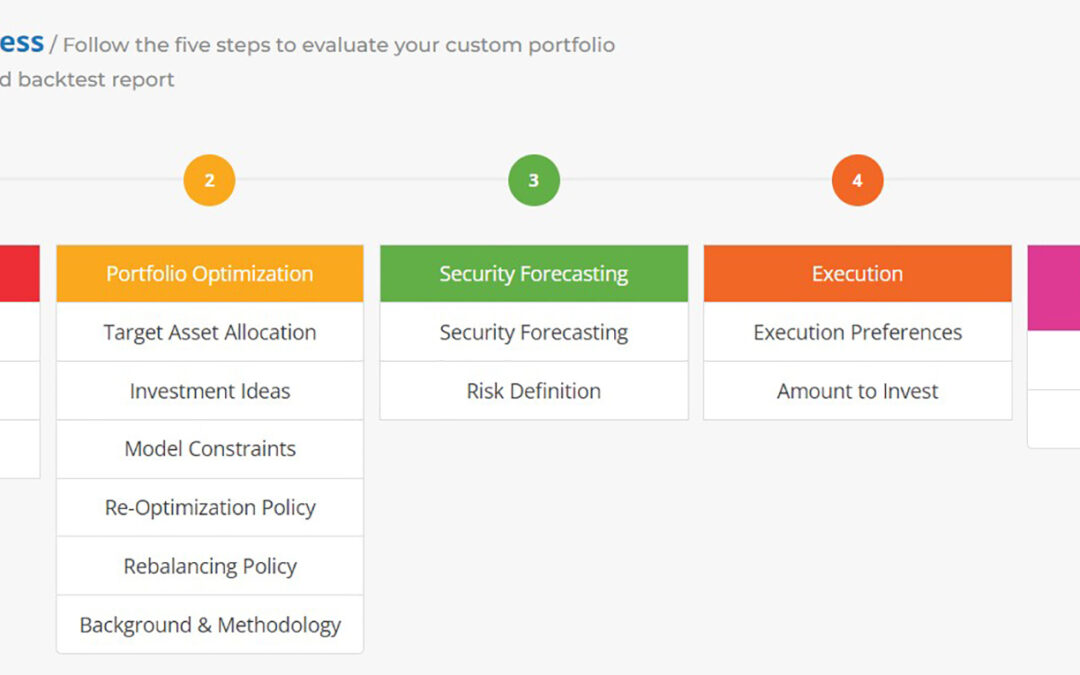

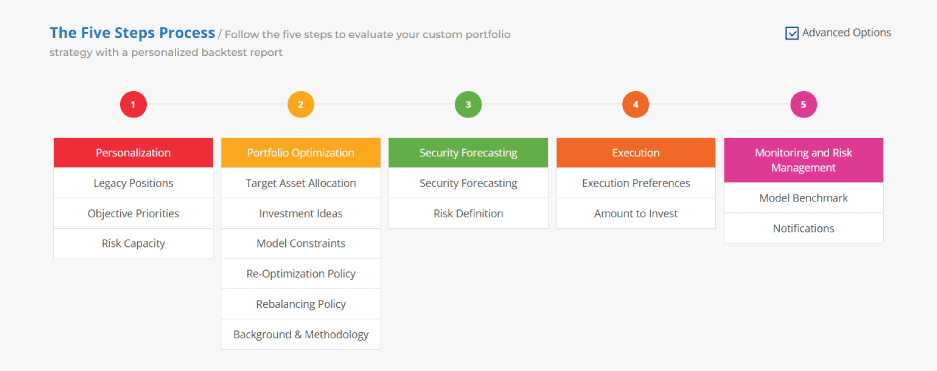

Investment Policy Statement (IPS) come in all shapes and sizes. I recommend that you keep it shorter and don’t put anything in there that you don’t understand. If you get one from your financial institution – don’t hire them unless you understand it and agree with it! That’s what it’s for. Here is the menu of ours:

Investment Policy Statement (IPS)

Investment Policy Statement (IPS)

OK The above list represents the common knowledge of using an IPS. I would further add that (at least with our IPS) you end up creating a portfolio that is optimized and automated. These advantages are significant. Why do you think that nearly ALL larger pension funds and endowments have them? head to https://www.portfoliothinktank.com to draft your Investment Policy Statement. We will optimize and backtest it for your for free. If you like it, hire us to automate it for you.

You can get your free portfolio analytics by entering your portfolio here: https://www.gsphere.net/analyze

James’ professional orientation points at the zenith (and sometimes nadir) where technology and investments intersect. He is a Fintech entrepreneur and has served twenty years of a lifetime sentence.

James is a patented inventor, quant pioneer and investment manager. He is the founder of Gravity Investments, a unique investment and technology services firm centered on James’ inventions for diversification measurement, optimization, visualization, and analysis. In the development of the platform, James has pioneered A.I applications, diversification attribution, down-side diversification, portfolio re-optimization, full-lifecycle strategy optimization, programmable investment policy statements and core-satellite optimization techniques.

In working with advisors, funds and money managers as both a strategic sub-advisor and software consultant, James has consulted and trained hundreds of professional investors on portfolio design and optimization. James has a unique ability to look at any investment process and find practical, intelligent and often quantifiable opportunities to improve the investment product.

Inspired by the work of Nobel Laureate Harry Markowitz and the efficient frontier, James has championed and pioneered the science of diversification. James’ technology has advised

or assisted in over 30 Billion dollars of investor capital. His vision of a more perfect investment management system is at the heart of Gsphere ( www.gsphere.net )

His passion for performance, curiosity for the unknown, and drive to excel empower his service to investors.

James is Founder and CEO of Portfolio ThinkTank (the B2C company) www.portfoliothinktank.com, Founder & Chief of Financial Engineering at Gravity Investments www.gravityinvestments.com (the B2B company) and Chief Investment Officer at Gravity Capital Partners, a wholly owned SEC Registered Investment Advisor.