by James Damschroder | May 11, 2021 | Portfolio ThinkTank |

You need to restructure your conservative bond – heavy portfolios because of the risk and likelihood of rising inflation. Cutting your fixed income exposure in half is a good starting point. It’s likely that your conception of risk fails to account, in...

by James Damschroder | April 8, 2021 | Portfolio ThinkTank |

Fact Checking for Truths about Portfolio Diversification There are a number of misconceptions around diversification. But head and shoulders the number one misconception is so widespread, harmful and misunderstood. First, the also rans. Diversification is...

by James Damschroder | August 29, 2020 | Portfolio ThinkTank |

Many investors, especially venture capitalists, think of CEO’s as being either a peacetime CEO or a wartime CEO. Wartime is a metaphor typically for a peacetime or wartime national leader. I think investors need to start using this as a lens for self-evaluation....

by James Damschroder | July 30, 2020 | Portfolio ThinkTank |

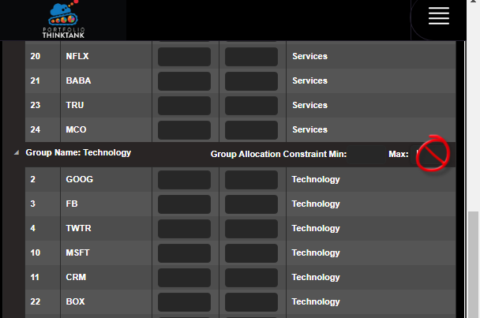

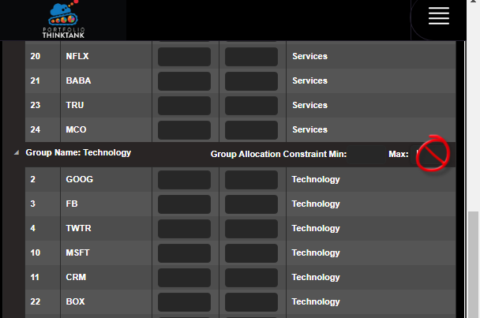

Proper Portfolio Construction is both art and science. Here is a little art. Why you should constrain all of your sectors except technology? What are portfolio constraints? Position constraints are a popular input to portfolio optimizers or asset allocation...

by James Damschroder | May 12, 2020 | Portfolio ThinkTank |

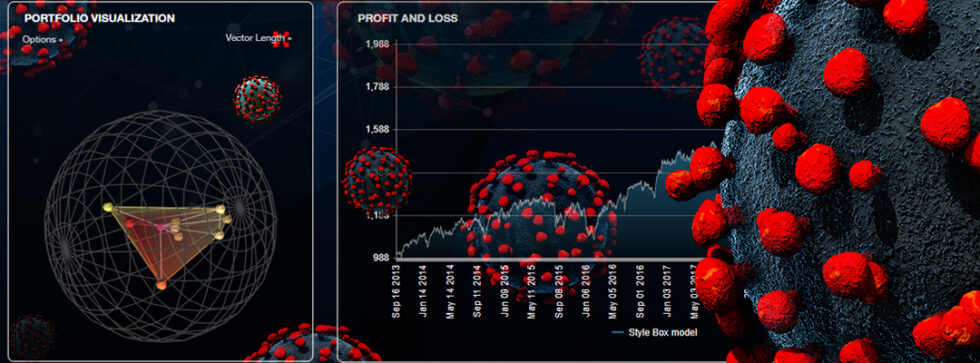

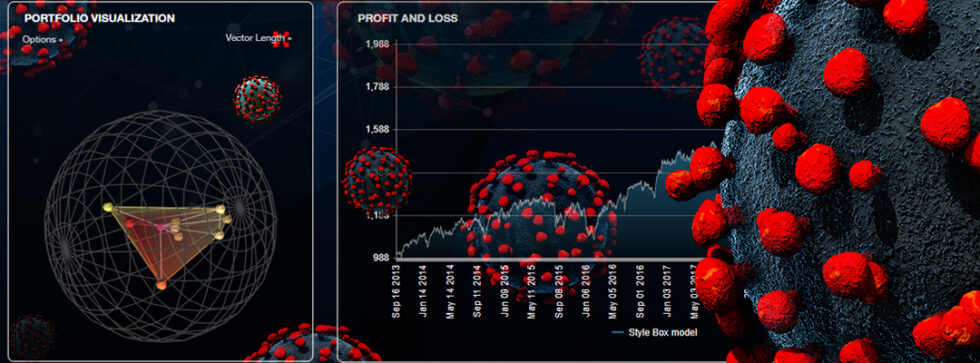

I track a list of 3 COVID 19 Stock ideas. Harmed is an equally weighted basket of 33 stocks that would stand to get their butt kicked by COVID19 and the resulting shutdown. Beneficiaries is an equally weighted basket of 33 stocks that one could imagine would benefit;...