by James Damschroder | November 26, 2020 | Portfolio ThinkTank |

In addition to an overload of turkey every Thanksgiving table I’ve sat at has had some sort of gratitude practice. Sometimes, this takes the form of going around the table where people can express things that they are thankful for. Other times the host could lead a...

by James Damschroder | August 29, 2020 | Portfolio ThinkTank |

Many investors, especially venture capitalists, differentiate CEOs as either peacetime or wartime leaders. The concept of “wartime” is often used to describe national leaders facing crises. Investors should consider adopting this perspective for their own...

by James Damschroder | July 30, 2020 | Portfolio ThinkTank |

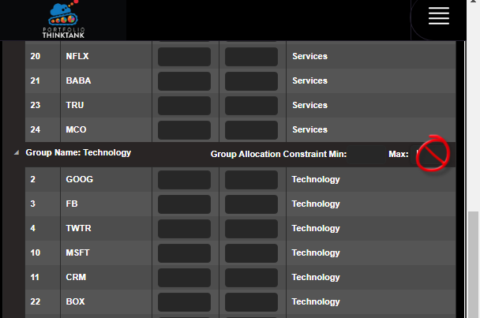

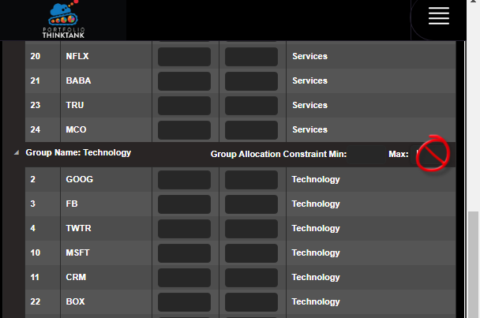

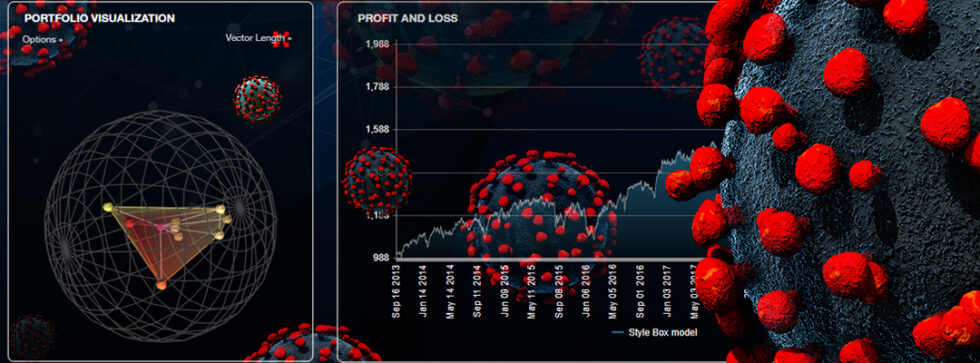

Strategic Tech Stock Allocations for Optimal Investment Growth Proper Portfolio Construction is both art and science. Here is a little art. Why you should constrain all of your sectors except technology? What are portfolio constraints? Position constraints are a...

by James Damschroder | May 12, 2020 | Portfolio ThinkTank |

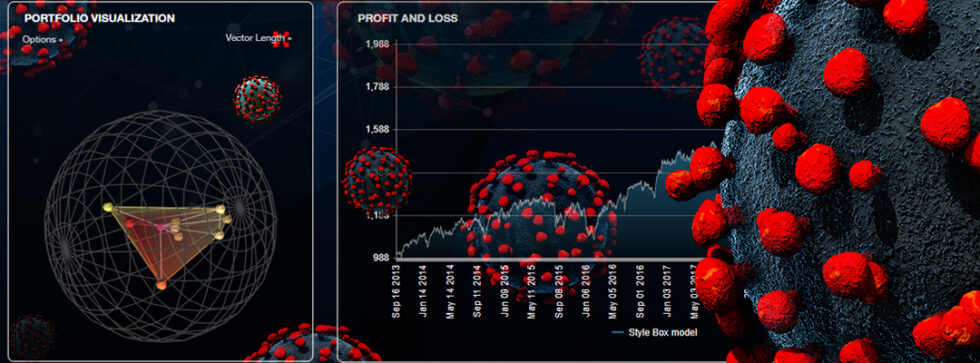

I track a list of 3 COVID 19 Stock ideas. Harmed is an equally weighted basket of 33 stocks that would stand to get their butt kicked by COVID19 and the resulting shutdown. Beneficiaries is an equally weighted basket of 33 stocks that one could imagine would benefit;...

by James Damschroder | May 1, 2020 | Portfolio ThinkTank |

Narrative Diversification – What is it and why does it matter? I want to call to attention a type of diversification that I think is especially relevant now and typically one that evades measurement. Narrative diversification. I’ve come across this type of...

by James Damschroder | April 22, 2020 | Portfolio ThinkTank |

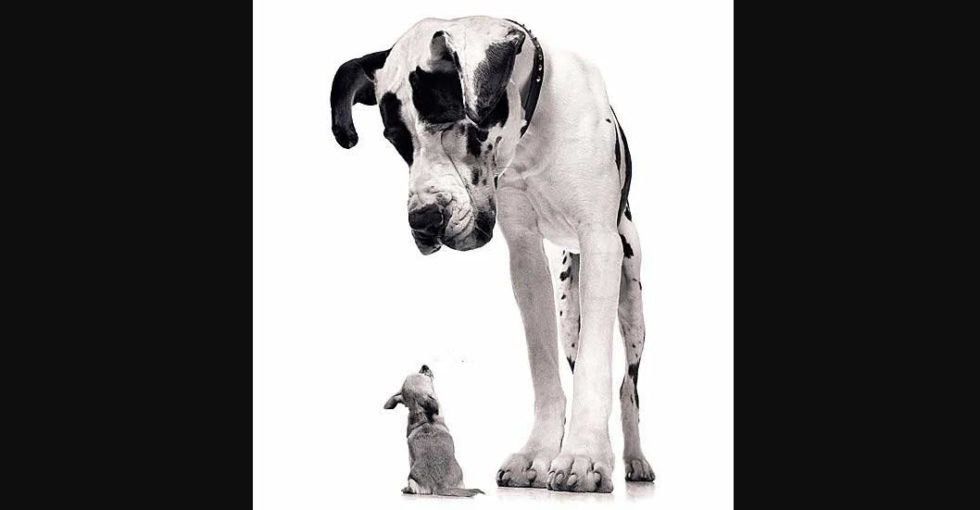

Large Cap vs Small Cap Investing: – Tilt your portfolio exposures for better investment performance. Historically, small cap stocks have outperformed large cap stocks. This no longer appears to be the case. Too bad, because there is a lot of diversification to...