by James Damschroder | January 14, 2025 | Uncategorized |

A thoughtful Investors’ Checklist of Diversifiable Risks I usually think about diversification as abstract dimensions, what some people call stat factors: they do not have discreet meaning individually, but collectively add it to measure the information /...

by James Damschroder | May 11, 2021 | Portfolio ThinkTank |

You need to restructure your Conservative Investment Portfolio, especially if it’s bond-heavy, due to the increasing risk and likelihood of rising inflation. Cutting your fixed income exposure in half is a good starting point. It’s likely that your...

by James Damschroder | April 8, 2021 | Portfolio ThinkTank |

Fact Checking for Truths about Portfolio Diversification There are a number of misconceptions around diversification. But head and shoulders the number one misconception is so widespread, harmful and misunderstood. First, the also rans. Debunking the Biggest...

by James Damschroder | August 29, 2020 | Portfolio ThinkTank |

Many investors, especially venture capitalists, differentiate CEOs as either peacetime or wartime leaders. The concept of “wartime” is often used to describe national leaders facing crises. Investors should consider adopting this perspective for their own...

by James Damschroder | July 30, 2020 | Portfolio ThinkTank |

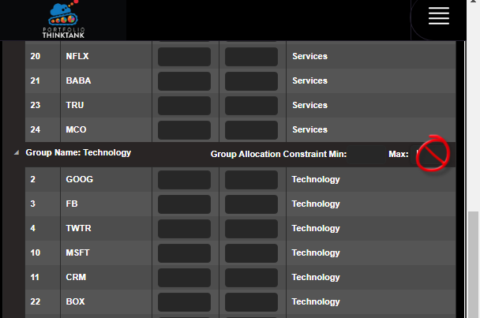

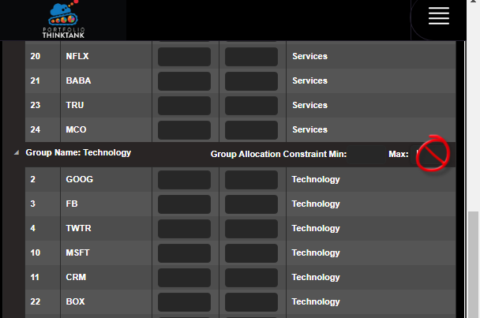

Strategic Tech Stock Allocations for Optimal Investment Growth Proper Portfolio Construction is both art and science. Here is a little art. Why you should constrain all of your sectors except technology? What are portfolio constraints? Position constraints are a...