by James Damschroder | September 28, 2021 | Portfolio ThinkTank |

I don’t usually advocate trading due to the higher probability of loss ascribed to the predominance of cognitive bias and behavioural economics. Note from personal experience that an awareness of such risk is insufficient to curtail the risks. For those that...

by James Damschroder | May 12, 2020 | Portfolio ThinkTank |

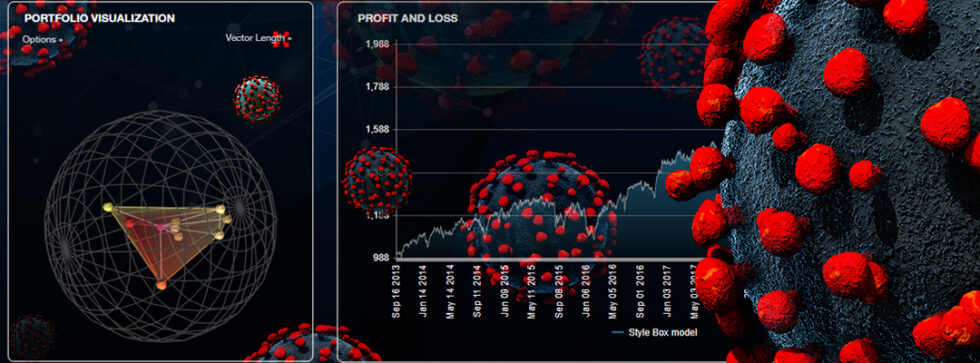

I track a list of 3 COVID 19 Stock ideas. Harmed is an equally weighted basket of 33 stocks that would stand to get their butt kicked by COVID19 and the resulting shutdown. Beneficiaries is an equally weighted basket of 33 stocks that one could imagine would benefit;...

by James Damschroder | May 1, 2020 | Portfolio ThinkTank |

Narrative Diversification – What is it and why does it matter? I want to call to attention a type of diversification that I think is especially relevant now and typically one that evades measurement. Narrative diversification. I’ve come across this type of...

by James Damschroder | April 21, 2020 | Portfolio ThinkTank |

The Dirty Secret of Diversification You probably heard mixed things about diversification; most of it good but not all of it. Amongst the detractors you can find content on the internet where Mark Cuban or Warren Buffett impune diversification. Please forgive their...

by James Damschroder | March 18, 2020 | Portfolio ThinkTank |

Cash + Quality + Cap = Comebackability A great many stocks are excellent investments right now. With the Coronavirus, I keep finding myself saying that “this too shall pass.” It will. Sooner or later. And when it does – you need to be ready. As there have...