by James Damschroder | May 26, 2021 | Portfolio ThinkTank |

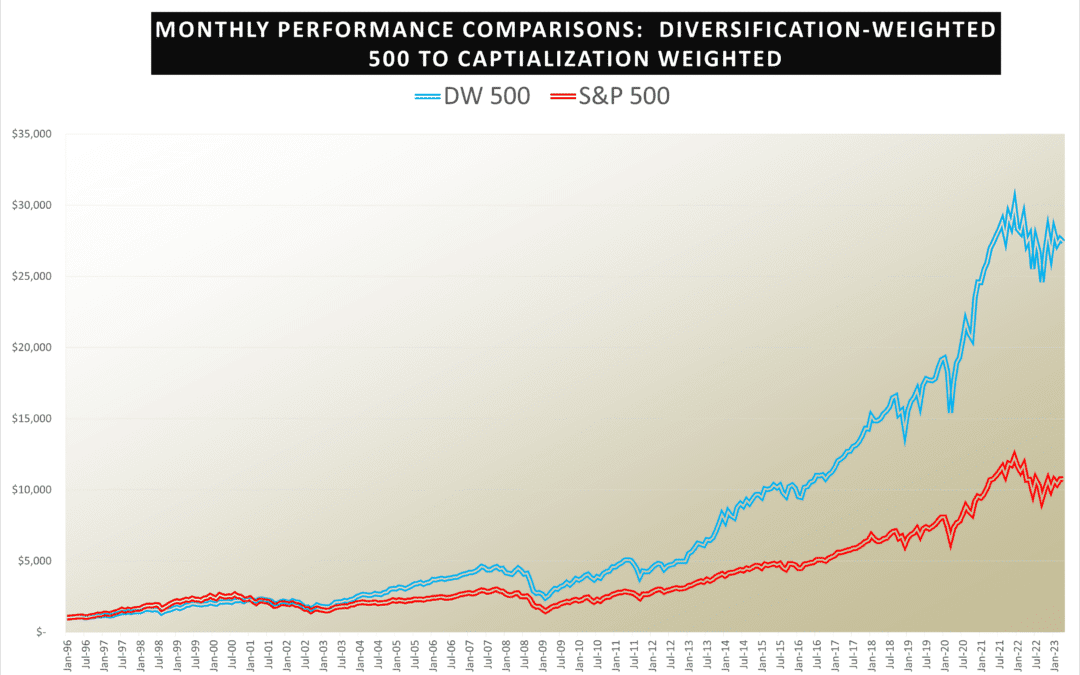

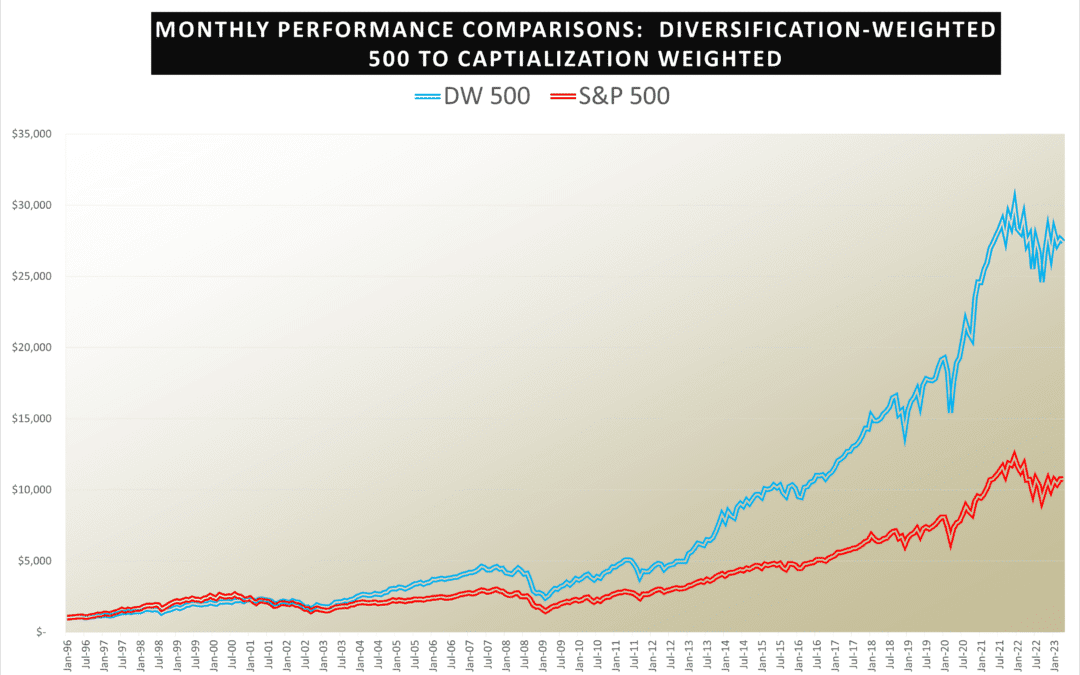

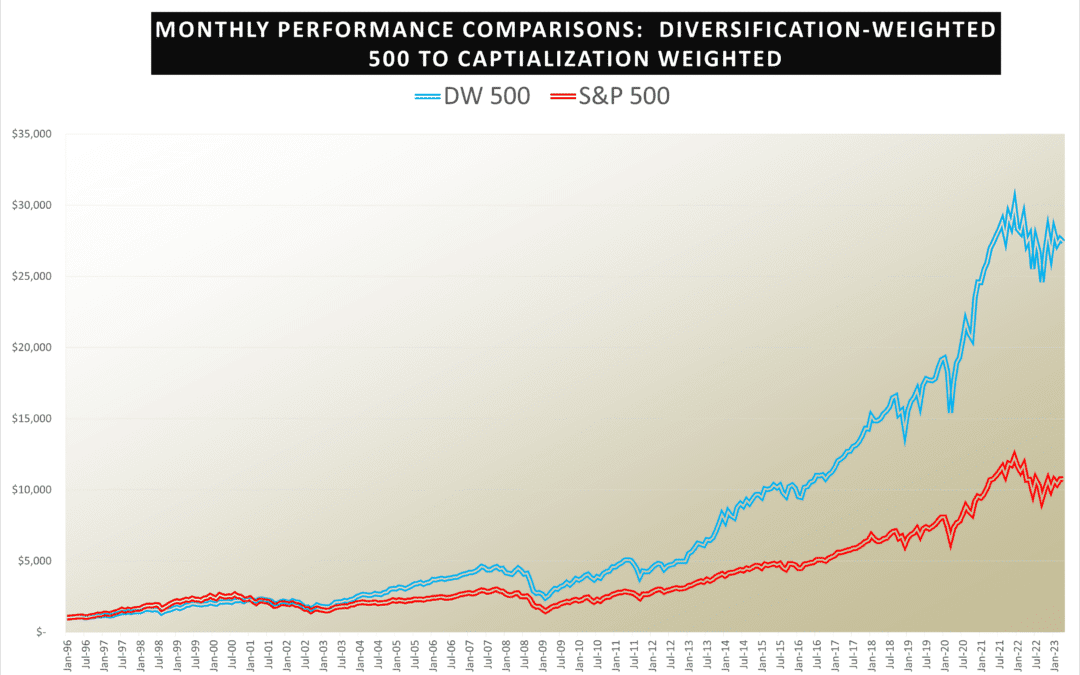

Just like Deion Sanders on the field, diversification goes both ways. Most investors intuit the benefit of defensive diversification, but diversification can play offense, too. The defensive ability of diversification to protect capital is a function of the...

by James Damschroder | May 11, 2021 | Portfolio ThinkTank |

You need to restructure your Conservative Investment Portfolio, especially if it’s bond-heavy, due to the increasing risk and likelihood of rising inflation. Cutting your fixed income exposure in half is a good starting point. It’s likely that your...

by James Damschroder | April 8, 2021 | Portfolio ThinkTank |

Fact Checking for Truths about Portfolio Diversification There are a number of misconceptions around diversification. But head and shoulders the number one misconception is so widespread, harmful and misunderstood. First, the also rans. Debunking the Biggest...

by James Damschroder | November 26, 2020 | Portfolio ThinkTank |

In addition to an overload of turkey every Thanksgiving table I’ve sat at has had some sort of gratitude practice. Sometimes, this takes the form of going around the table where people can express things that they are thankful for. Other times the host could lead a...

by James Damschroder | August 29, 2020 | Portfolio ThinkTank |

Many investors, especially venture capitalists, differentiate CEOs as either peacetime or wartime leaders. The concept of “wartime” is often used to describe national leaders facing crises. Investors should consider adopting this perspective for their own...