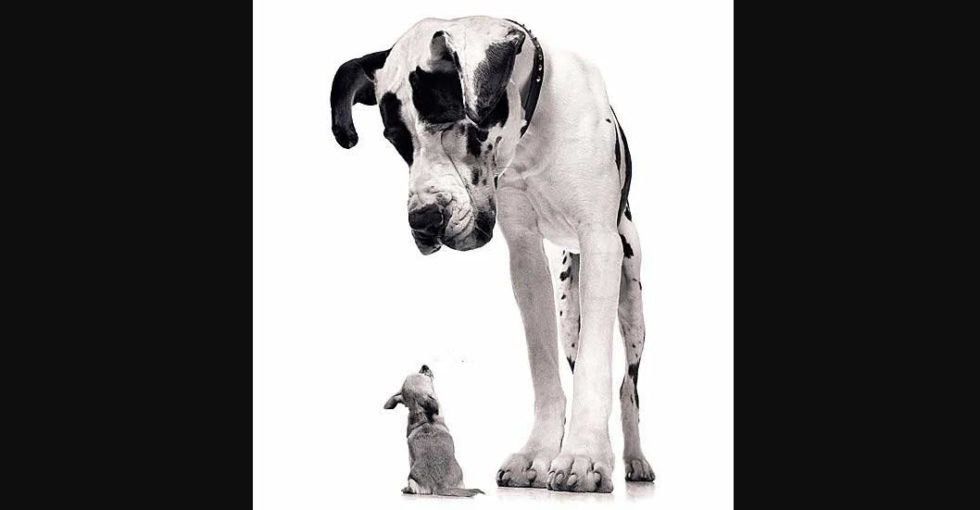

Large Cap vs Small Cap Investing: – Tilt your portfolio exposures for better investment performance.

Historically, small cap stocks have outperformed large cap stocks. This no longer appears to be the case. Too bad, because there is a lot of diversification to be found in small caps.

Large Cap stocks are stocks with a market capitalization (value) greater than ~ 10 billion dollars. Small Cap stocks are stocks with a market cap under 2 billion dollars. In between are the midcaps.

Here is what is happening:

I used to believe that small caps were the better bet, offering an acquisition premium, an under the regulatory radar premium, and a more room to grow premium. But for most of the last decade large cap has outperformed small cap. Here is why I think this trend will continue for the 2020’s. Take a look at the chart to see where we have been and then we will make the case for large cap dominance in the 2020’s.

The big driver:

Index based investing strategies now account for 50% of the market. Buyers of Index funds are propping up large cap stocks because index funds are predominantly large cap. Nearly all capitalization weighted index funds are essentially large cap. For example, Morningstar ranks the S&P 500 as 90% large Cap. No surprise there. But if you look at the Russell 3000, which is ~ the 3000 largest stocks, Morningstar shows that the fund is 80% large cap, 15% MidCap and only 5% small cap, despite small caps outnumbering both mid and large by 2 to 1.

New buyers of such funds compound the performance of that which they are buying :index fund. In addition to this huge factor, we see 5 other factors that we believe will sustain the performance of large cap stocks over small cap stocks in the years ahead.

The five other reason to go big:

-

- Successful startup companies raise so much money now that they can afford to stay private longer, pushing more of the return that used to belong to small cap investors now into the hands of late-stage venture capitalists.

- Increased regulatory and reporting requirements have raised the bar of what is needed to public companies to operate sustainably. Most public companies under 100M are walking dead.

- Global technology platforms operate with monopolistic behaviors effectively capping the success by new market entrants and dissipating the opportunities catalyzed by successful local enterprises.

- Increased globalization forces companies to compete on global scale from a much earlier point in their gestation, forcing an “up or out” competitive battle of efficiencies and scale

- The internet has truly come of age. Like other great technology ages in our history, such as electricity, the automobile, the telephone, the TV as the age begins to mature, the top companies driving the age forward consolidate their powers and tip the balance of power in favor or the large caps (theorized).

Unless we see baby boomers drawing down their retirement accounts in droves sufficient to create regular and consistent net fund outflows, I think you can bet on big ones.

James’ professional orientation points at the zenith (and sometimes nadir) where technology and investments intersect. He is a Fintech entrepreneur and has served twenty years of a lifetime sentence.

James is a patented inventor, quant pioneer and investment manager. He is the founder of Gravity Investments, a unique investment and technology services firm centered on James’ inventions for diversification measurement, optimization, visualization, and analysis. In the development of the platform, James has pioneered A.I applications, diversification attribution, down-side diversification, portfolio re-optimization, full-lifecycle strategy optimization, programmable investment policy statements and core-satellite optimization techniques.

In working with advisors, funds and money managers as both a strategic sub-advisor and software consultant, James has consulted and trained hundreds of professional investors on portfolio design and optimization. James has a unique ability to look at any investment process and find practical, intelligent and often quantifiable opportunities to improve the investment product.

Inspired by the work of Nobel Laureate Harry Markowitz and the efficient frontier, James has championed and pioneered the science of diversification. James’ technology has advised

or assisted in over 30 Billion dollars of investor capital. His vision of a more perfect investment management system is at the heart of Gsphere ( www.gsphere.net )

His passion for performance, curiosity for the unknown, and drive to excel empower his service to investors.

James is Founder and CEO of Portfolio ThinkTank (the B2C company) www.portfoliothinktank.com, Founder & Chief of Financial Engineering at Gravity Investments www.gravityinvestments.com (the B2B company) and Chief Investment Officer at Gravity Capital Partners, a wholly owned SEC Registered Investment Advisor.